In an unanticipated movement, Galaxy Digital—once a stalwart in institutional crypto management—has initiated a significant cash-out, transferring over 17,000 BTC to prominent exchanges within a single day. This act of liquidating assets valued at more than $1.7 billion at current market rates is more than mere portfolio management; it is an indicator of potential bearing down on the market’s stability. While the story appears to be a strategic institutional move, the scale and timing raise questions about underlying confidence in Bitcoin’s near-term prospects. The fact that these transactions originated from a company that often manages complex asset portfolios suggests a calculated decision rather than a panic sale, but the market’s reaction indicates a different reality of unease and anticipation.

Consolidation and Disposition: A Clear Shift in Strategy

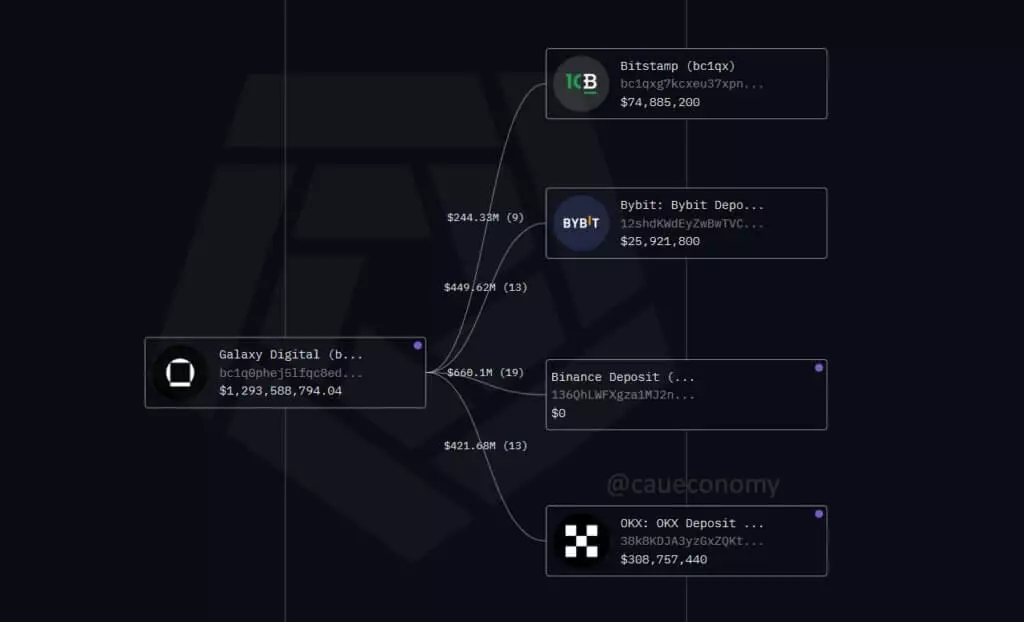

It’s worth noting that this recent upheaval follows Galaxy Digital’s remarkable accumulation of Bitcoin—an increase from less than a billion to over six billion dollars’ worth of holdings in just a few days. The reorganization involved consolidating a massive 80,000 BTC, some dormant since 2011, into a single robust position. The move to offload a substantial portion of these holdings onto exchanges hints at a fear of missed opportunities, or perhaps, the start of a broader capital reallocation. This pattern of moving large sums from long-held, inactive wallets demonstrates a willingness to transition from a cautious custody stance toward liquidity readiness. Yet, the timing and manner of these transfers—staggered batches that appear designed for distribution rather than cold storage—are more reminiscent of strategic cash-out than passive asset management.

Market Implications: Fear or Foresight?

The immediate consequence of such a large-scale distribution is palpable: Bitcoin’s price has dipped roughly 2.5% in 24 hours, underscoring market sensitivity to potential selling pressure. Trading volumes above $94 billion indicate active engagement, but the question remains whether this is fear-induced capitulation or a calculated rebalancing by institutional players. The declining price and the pattern of transfers—particularly the outward flow reaching exchange hot wallets—lean towards distribution. This trend naturally stokes fears of broader sell-offs, especially because the market’s order books are notably thin, amplifying downward moves. While technical analysts monitor these on-chain signals, the real concern is whether this constitutes the beginning of a sustained decline or merely a temporary adjustment.

Institutional Strategy or Panic? The Future of Bitcoin’s Bull Run

While Galaxy Digital has not publicly clarified the purpose of these transactions, the broader narrative points to a strategic unwinding rather than panic selling. Firms like Galaxy traditionally handle client assets, and their moves heavily influence institutional sentiment. If this pattern of offloading continues, it might signal a cautious stance amid volatile macroeconomic conditions, growing regulatory scrutiny, or simply an optimistic locking-in of profits. Interestingly, despite the current downside, some remain optimistic that institutions are merely repositioning, not retreating. Yet, the reluctance to publicize the destination or purpose of the transfers fuels skepticism. This episode underscores a critical reality: Bitcoin’s market resilience remains tethered to institutional confidence, and sudden large movements have outsized potential to alter investor perceptions.

Leave a Reply