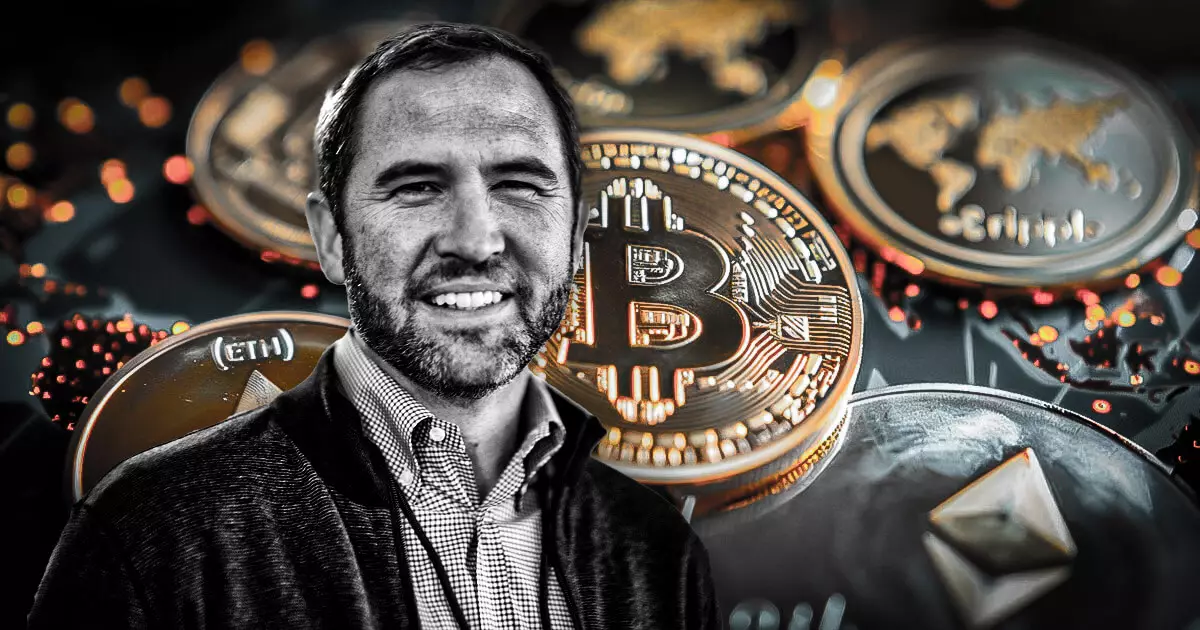

In recent developments, Ripple’s CEO Brad Garlinghouse has expressed a cautiously optimistic outlook regarding the future of cryptocurrency regulations in the United States. Following his meetings with several influential lawmakers in Washington, D.C., including prominent figures such as Senators Tim Scott and Chuck Schumer, Garlinghouse noted a growing opportunity to foster bipartisan support for clearer regulations surrounding digital assets. This face-to-face engagement signifies a potential paradigm shift in how lawmakers approach the booming cryptocurrency sector.

Garlinghouse’s assertion highlights a crucial moment where governmental engagement is becoming more approachable, particularly as policymakers seek to balance innovation and market stability. The dynamic discussions suggest that there is a renewed willingness among lawmakers to create a regulatory framework that not only allows for the growth of digital currencies but also provides the necessary safeguards to protect investors and maintain market integrity.

The Legislative Momentum for Cryptocurrency Oversight

A notable development in the realm of cryptocurrency legislation is the recent push to introduce clearer laws that govern stablecoins—a segment of the crypto market that has gained substantial traction. The progress of bills such as the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act exemplifies Congress’s commitment to establishing a structured approach to cryptocurrency oversight. These legislative proposals aim to impose licensing requirements and risk management strategies for stablecoin issuers, reflecting an effort to align the rapidly evolving crypto space with traditional financial standards.

However, while these initiatives are promising, there exists a veil of uncertainty regarding their implementation. The evolving dynamic between cryptocurrency entities and regulatory agencies must be navigated carefully to ensure that innovation does not taper off under the weight of stringent regulations. The crypto industry remains watchful, knowing that the outcome of these legislative efforts will shape its future in the United States.

The Role of Regulatory Agencies

Adding another layer to this evolving narrative are the regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Both agencies are under scrutiny as they craft frameworks that aim to strike a balance between fostering economic growth and ensuring market integrity. The appointments of individuals with pro-crypto stances to lead these agencies, such as former SEC Commissioner Paul Atkins and Brian Quintenz at the CFTC, signal a willingness to engage with the cryptocurrency sector more collaboratively.

This shift in leadership reflects the broader sentiment across the crypto industry—an appetite for regulation that encourages innovation rather than stifling it. For many stakeholders, these developments are crucial in maintaining confidence in the evolving market as the U.S. seeks to position itself as a leader in the digital economy.

The landscape of cryptocurrency regulation in the United States appears to be undergoing a transformation, driven by enhanced dialogue between industry leaders and lawmakers. As leaders like Brad Garlinghouse guide conversations toward supportive regulation, the future may hold a more structured and stable environment for digital assets. However, while these discussions are encouraging, market participants must remain vigilant, as the successful implementation of these initiatives and the actual regulatory landscape will ultimately determine the viability and growth potential of cryptocurrency in the U.S.

Leave a Reply