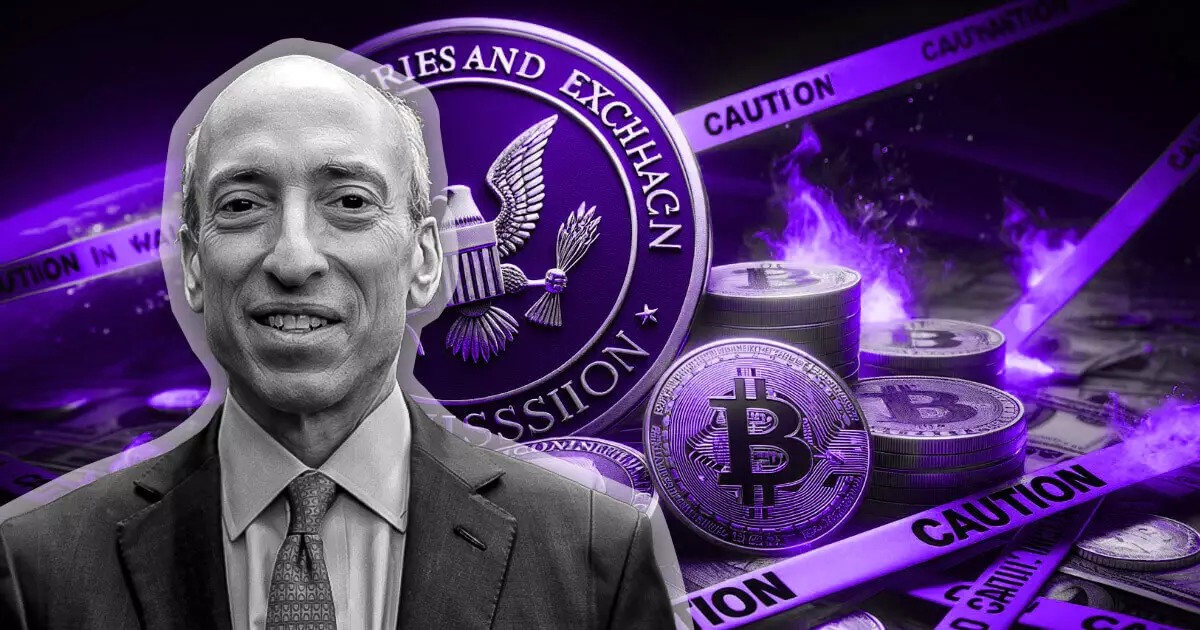

In a recent dialogue on CNBC’s Squawk Box, the US Securities and Exchange Commission (SEC) Chair Gary Gensler made a significant point about Bitcoin’s classification, affirming that Bitcoin is not deemed a security. This remark aims to clarify the ongoing regulatory discussions that have enveloped the cryptocurrency sector. Gensler indicated that both he and his predecessor have consistently asserted that Bitcoin falls under the category of a commodity rather than a security, a classification that enables it to be traded on major exchanges such as Nasdaq, especially following the SEC’s recent approval of several spot Bitcoin exchange-traded funds (ETFs). By delineating Bitcoin’s status, Gensler attempts to stabilize its position in the volatile crypto landscape.

While Gensler’s affirmation about Bitcoin is a step in the right direction, his comments also included a scathing critique of the broader cryptocurrency sector. He pointed out a troubling trend: many participants in the crypto market seem to disregard established regulations. Based on Gensler’s observations, this negligence has exacerbated instability and confusion within the market, leaving investors at risk. He emphasized that regulatory frameworks exist to protect investors and to encourage a transparent market environment, yet many in the crypto world have opted to dismiss these rules. This raises critical questions about the irresponsibility of market players and the potential risks they pose to the integrity of the financial system.

In contrast to the clear classification of Bitcoin, Ethereum’s regulatory status remains murky, elucidating a significant gap in the SEC’s approach. Gensler has yet to definitively categorize Ethereum as either a security or a non-security, resulting in a cloud of uncertainty surrounding various projects built on its blockchain. This ambiguity resonates among developers who are wary of potential regulatory repercussions. Even as Ethereum-based ETFs received approval, investigations into companies linked to the Ethereum ecosystem, such as Consensys and Uniswap, have raised further eyebrows. Such duality in the SEC’s approach to cryptocurrency regulation not only creates confusion but also can inadvertently stifle innovation.

Gensler’s handling of crypto regulations has not gone unnoticed by policymakers. Many members of Congress have expressed their disdain for the SEC’s lack of clarity, criticizing the chair for contributing to a convoluted regulatory environment. The introduction of terms like “crypto asset security” by Gensler has particularly frustrated lawmakers, as they see such ambiguity as a hindrance to innovation. Even some of his fellow commissioners—including Hester Peirce and Mark Uyeda—have voiced their support for these criticisms.

Despite the backlash, Gensler remains steadfast in his belief that robust regulatory frameworks are essential for the future of the cryptocurrency industry. He posits that investor trust is pivotal in fostering a healthy crypto market, whereby regulations can act as “traffic lights and stop signs” to guide and stabilize the industry. This metaphor emphasizes the necessity of regulatory structures, not only for Bitcoin but for a sustainable future for all digital assets. However, as the SEC’s policies become increasingly scrutinized, the future of crypto regulation continues to hang in the balance, with many stakeholders calling for greater clarity and consistency.

Leave a Reply