The ongoing legal tussle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs has captured significant attention within the cryptocurrency landscape. Since the SEC launched its lawsuit against Ripple in December 2020, the case has been emblematic of the broader regulatory challenges facing the cryptocurrency industry. At the heart of the conflict lies the SEC’s assertion that Ripple’s sales of XRP constituted a $1.3 billion unregistered securities offering. This claim raises fundamental questions about the classification of digital assets and the extent of regulatory authority over emerging financial technologies.

In August 2023, U.S. District Judge Analisa Torres delivered a mixed verdict that favored Ripple in certain respects, ruling that programmatic sales of XRP, typically sold to retail investors through crypto exchanges, did not breach securities laws. This decision was pivotal, as it suggested a potential legal framework that distinguishes between different types of cryptocurrency sales. However, the judge also concluded that Ripple’s direct sales to institutional investors, which amounted to approximately $728 million, were indeed unregistered securities transactions, imposing a hefty $125 million penalty on the company. Despite the adverse judgment, Ripple’s initial response was one of relief, viewing parts of the ruling as a turning point in favor of the broader crypto industry.

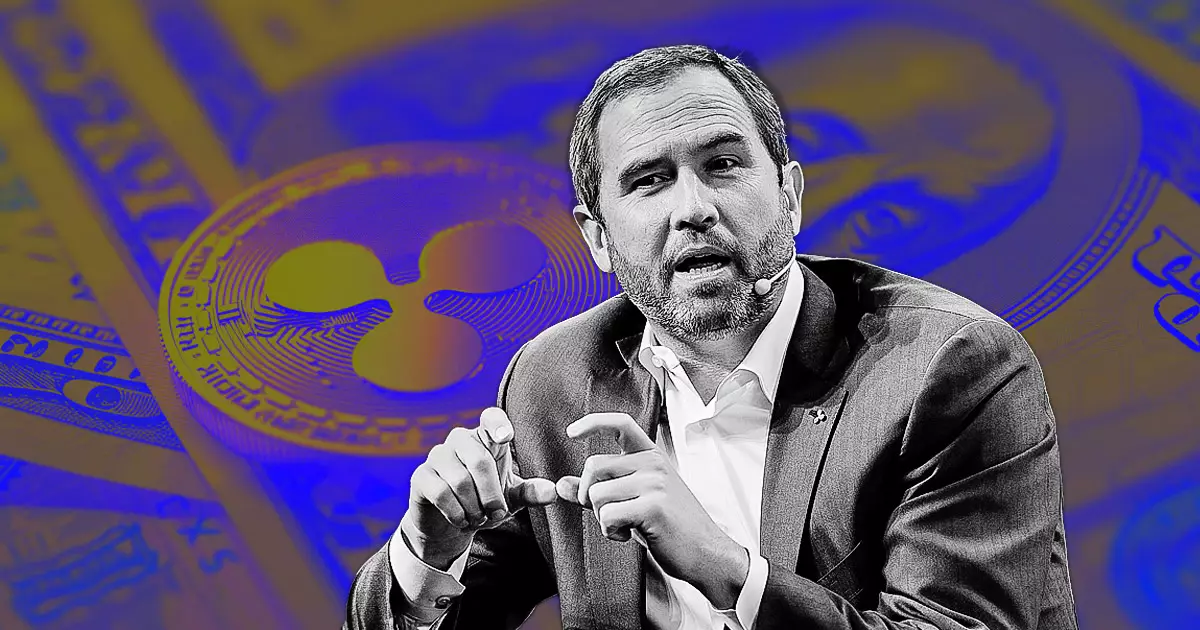

On October 2, 2024, the SEC announced its intention to appeal the ruling, reigniting the contentious atmosphere surrounding the case. This decision aligns with the SEC’s historical approach to assert its jurisdiction over digital assets, which often results in legal entanglements that send shockwaves across the cryptocurrency market. Ripple CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty expressed significant disappointment regarding the SEC’s persistence in challenging the court’s previous decisions, signaling a determination to continue the fight in court.

Garlinghouse has been vocal in his criticism of the SEC under Chairman Gary Gensler, labeling the agency’s ongoing legal efforts as a waste of taxpayer resources. He emphasized that the key aspects of the case had already been resolved in Ripple’s favor and insisted that the classification of XRP as a non-security continues to stand irrespective of the appeal. Alderoty reinforced this perspective by highlighting the absence of actual victims or financial losses related to Ripple’s actions, arguing that the SEC’s litigious behavior constitutes a form of “litigation warfare” against the burgeoning crypto sector.

The news of the SEC’s appeal has had immediate ramifications in the cryptocurrency markets, with XRP’s value experiencing a steep decline. Within a day, the digital asset dropped by approximately 9%, dipping below the $0.54 mark. Such market volatility illustrates the degree of uncertainty surrounding regulatory actions and their potential impacts on cryptocurrency valuations. As of the latest updates, XRP is ranked seventh in market capitalization, with a substantial market cap of $30.88 billion.

Investor sentiment amidst the SEC’s appeal is fraught with anxiety and skepticism. The regulatory landscape is perceived as increasingly hostile, casting a shadow over the industry’s future. The ongoing back-and-forth between regulatory authorities and cryptocurrency firms raises concerns over innovation in a sector that is still in its formative stages. Many in the industry advocate for clearer regulatory guidance that fosters innovation while ensuring compliance.

As the legal battle between the SEC and Ripple continues, the outcome of this case may have far-reaching implications for the entire cryptocurrency landscape. The case not only impacts Ripple and its stakeholders, but it also serves as a potential precedent for how other digital assets will be regulated in the future. The uncertainty and regulatory scrutiny that accompany such high-profile cases may stifle innovation, deter investment, and make it more challenging for legitimate businesses to thrive within the U.S. market.

Beyond the courtrooms, the Ripple case is illuminating the need for clearer regulatory frameworks that acknowledge the unique characteristics of digital assets. Stakeholders across the industry are urging regulators to collaborate with industry participants to foster an environment that encourages innovation while safeguarding investors. The dialogue surrounding regulatory clarity and legal accountability may ultimately shape the future trajectory of the cryptocurrency industry within the United States and beyond.

While Ripple’s fight against the SEC embodies a broader struggle for regulatory clarity, it also highlights the challenges and opportunities facing the cryptocurrency marketplace. As both parties prepare for the next chapter in this ongoing legal saga, the stakes remain high not only for Ripple but for the entire digital currency ecosystem.

Leave a Reply