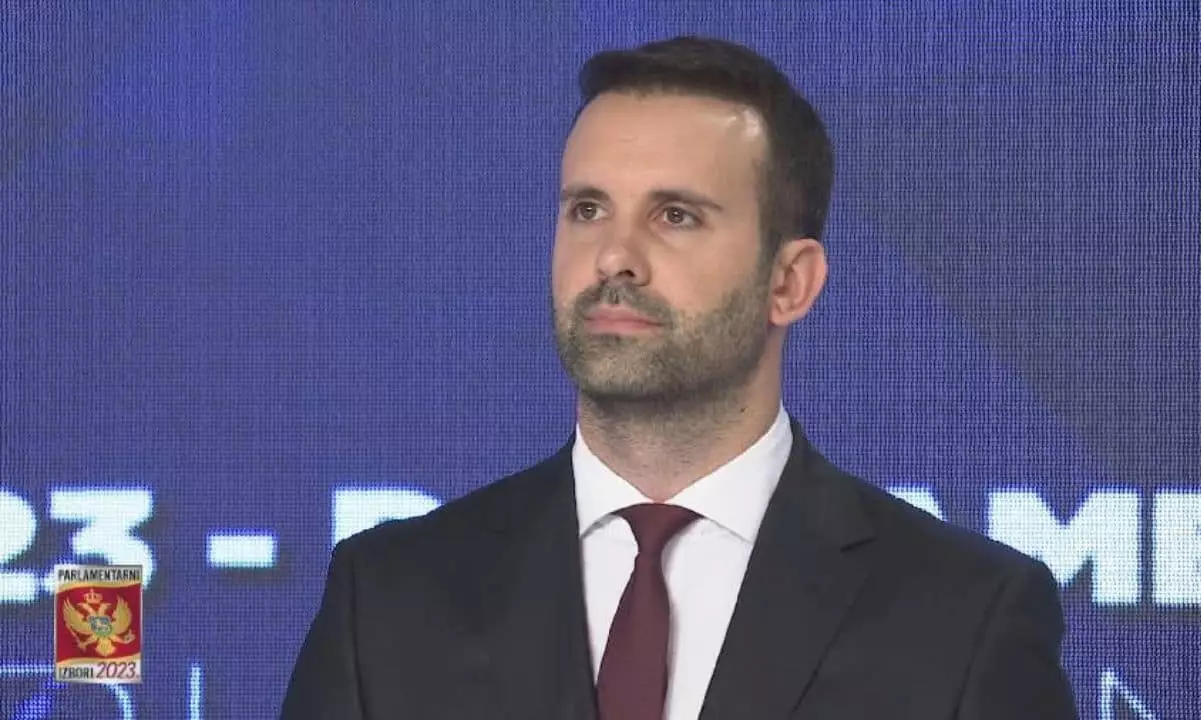

Recent reports have revealed that Montenegrin Prime Minister Milojko Spajić was among the early investors in Terraform Labs. In April 2018, Spajić invested $75,000 in the project, acquiring 750,000 Luna tokens at a price of $0.10 each. This made him the 16th investor during Terraform Labs’ initial fundraising phase.

Unfortunately, Terraform Labs’ cryptocurrency project ultimately failed in 2022, leading to losses exceeding $40 billion for investors worldwide. The collapse of the Luna token value from $119 to nearly zero resulted in significant losses for all those who had invested in the project.

Throughout the scandal, Spajić maintained that it was his employer, not he personally, who was defrauded of the investment. However, financial experts believe that if Spajić had retained his tokens through the market’s peak in early 2022, he would have faced losses nearing $90 million as the token value plummeted.

It is unclear whether Spajić asked for his investment to be returned or for compensation for lost profits from Do Kwon, the founder of Terraform Labs. Furthermore, it remains unknown if Spajić sued Terraform Labs and Kwon for fraud, as he did not address these questions. Meanwhile, Terraform Labs and Kwon have since been held accountable for defrauding investors, with the SEC securing a settlement requiring the company to pay $4.37 billion in fines and interest, and Kwon to contribute $200 million to an investor compensation fund.

The investment made by Montenegrin Prime Minister Milojko Spajić in Terraform Labs serves as a cautionary tale of the risks associated with early-stage investments. Despite initial success, the project’s failure led to significant financial losses for investors worldwide. The legal actions taken against Terraform Labs and its founder underscore the importance of due diligence and transparency in the world of cryptocurrency investments. It is essential for investors to thoroughly research and assess the risks involved before committing their funds to any project.

Leave a Reply