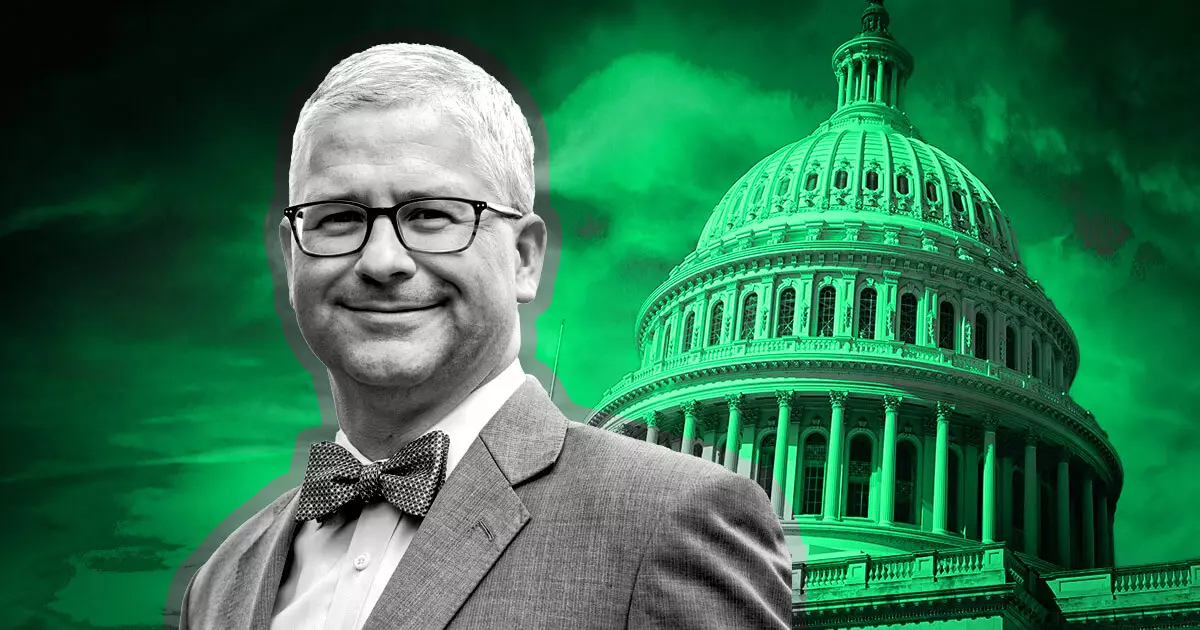

The crypto industry is on the brink of a potential breakthrough in terms of regulatory oversight with the introduction of the Financial Innovation and Technology for the 21st Century (FIT21) Act. This proposed legislation, set for a House floor vote by the end of May, aims to address longstanding issues of market oversight and consumer protection in the digital assets space. House Financial Services Committee Chairman Patrick McHenry emphasized the importance of this legislation in providing much-needed clarity to the U.S. digital asset ecosystem.

The FIT21 Act seeks to establish clear regulatory frameworks for digital assets by assigning jurisdiction to the Commodity Futures Trading Commission (CFTC) over crypto commodities and to the Securities and Exchange Commission (SEC) over crypto offered within investment contracts. This delineation aims to provide guidance to crypto developers on fundraising activities and determine whether their operations fall under CFTC or SEC oversight.

One of the key aspects of the FIT21 Act is to address the contentious issue of the SEC’s expanding enforcement efforts within the crypto space. By setting clear boundaries between the SEC and the CFTC, the legislation aims to mitigate some of the controversies surrounding regulatory uncertainty. This distinction could potentially offer relief to crypto market participants by providing a structured approach to compliance and enforcement.

In addition to defining the roles of regulatory bodies, the FIT21 Act establishes rules for companies operating in the crypto space. These rules include requirements for customer disclosure, asset safeguarding, and operational procedures. By setting clear guidelines for registration with the SEC and CFTC, the legislation aims to enhance transparency and accountability within the industry.

The FIT21 Act represents a significant step towards providing regulatory clarity and oversight in the rapidly evolving crypto industry. If passed, this legislation could have far-reaching implications for how digital assets are regulated and traded in the United States. As the House prepares for a potential floor vote on the FIT21 Act, the crypto community awaits eagerly to see the outcome of this critical legislative initiative.

Leave a Reply