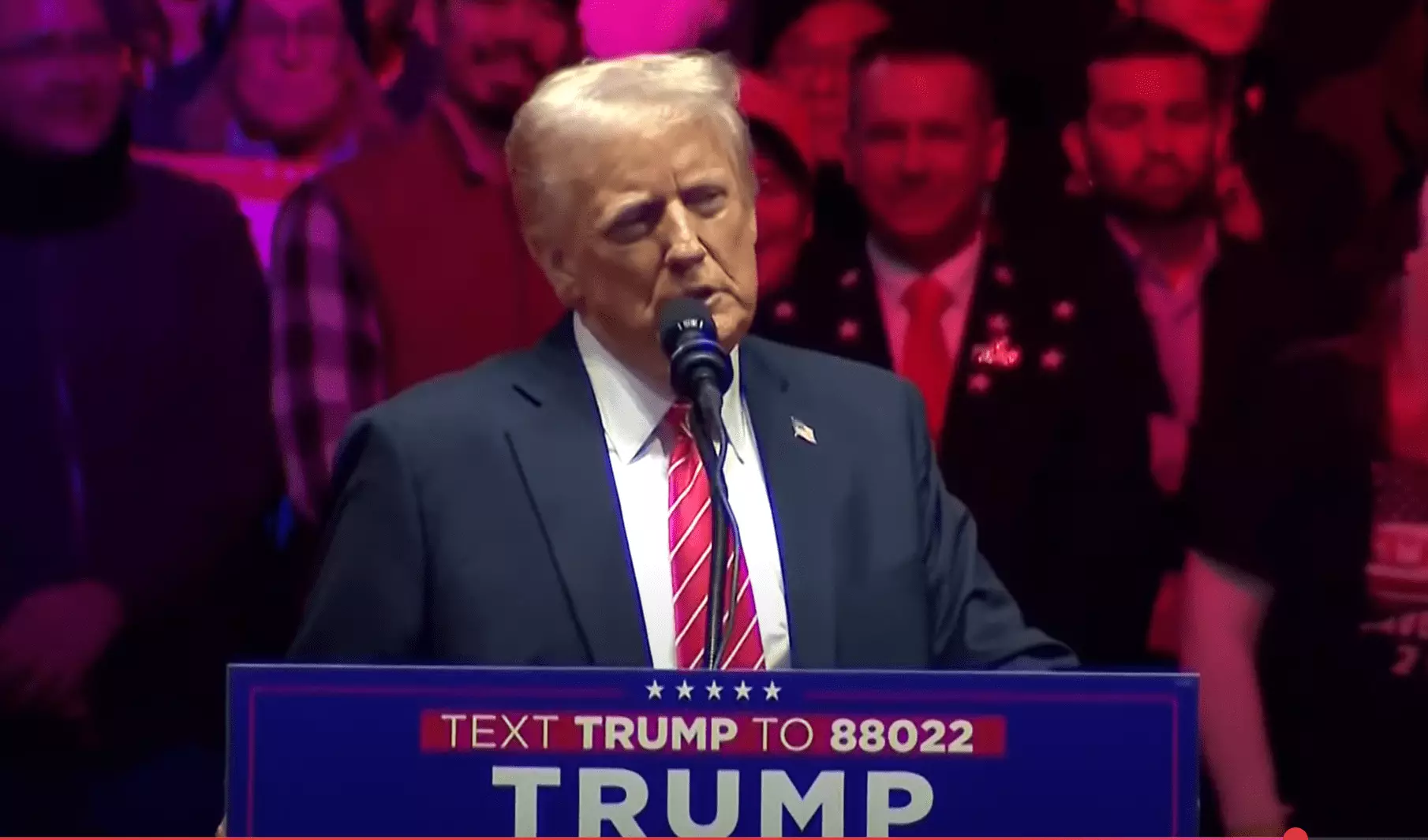

Bitcoin, the flagship of the cryptocurrency world, has seen a remarkable surge in its value, reaching an unprecedented high of $109,558 during early Asian trading hours. This coincides with a pivotal moment in U.S. history: the inauguration of President Donald Trump. As market experts scrutinize the implications of this timing, the conversation around a potential Strategic Bitcoin Reserve (SBR) has intensified, igniting speculation and attracting the attention of investors and advocates alike.

In the lead-up to Trump’s inauguration, discussions about the establishment of a U.S. Bitcoin reserve swelled, particularly fueled by trading data from predictive platforms like Polymarket, which suggested a heightened probability of such an initiative occurring within Trump’s initial 100 days. The odds hitting 59% marked a significant shift in optimism that preceded Bitcoin’s rapid escalation to new heights. Historically, Trump’s platform has hinted at the potential for consolidating seized Bitcoin by law enforcement into a government-backed reserve. While formal acknowledgment from the administration remains absent, the vibrant rumors surrounding an executive order being signed “as early as Inauguration Day” have set the stage for a boom in Bitcoin’s market confidence.

Various influential figures within the Bitcoin space have emerged, participating in meetings with Trump’s team, further fueling the flames of speculation regarding an SBR. Senators Mikey Barrasso and Cynthia Lummis, both vocal proponents of cryptocurrency, expressed their optimistic conversations around a potential governmental initiative in Tweets. Lummis has been particularly instrumental, pushing legislative efforts aimed at solidifying a Bitcoin reserve as part of broader digital asset regulation. Such political engagement suggests a synergistic relationship between the incoming administration and the cryptocurrency community.

MicroStrategy Chairman Michael Saylor was also seen actively networking within the incoming cabinet. His engagement underscored a growing connection between traditional finance leaders and the cryptocurrency sector, revealing a potential shift in how Bitcoin is perceived at high levels of governance. The combination of Trump’s inauguration and these high-profile meetings indicates a historical moment where the realms of politics and cryptocurrency may become intertwined more than ever before.

The response within the market to these developments has been immediate and pronounced. Following periods of volatility, analysts like Charles Edwards observed Bitcoin’s transient drops, suggesting that such oscillations could be precursors to more sustained growth. The robust reactions in the Bitcoin market—characterized by aggressive movements in both directions—signal a possibility for a new trend that could redefine investment strategies. Edwards’ insight into the market’s behavior post-disruptions reflects a cautious optimism that is vital, given the inherently unpredictable nature of cryptocurrency trading.

The anticipatory buzz transferred to social media platforms, where figures close to the Trump administration and Bitcoin advocates shared their enthusiasm for the future of the digital asset. Posts showcasing their mutual understandings further emphasize the unique climate around Bitcoin and its increasing legitimacy within governmental discussions. As the speculation on an SBR grows, so too does the involvement of notable investors and entrepreneurs who manifest their faith in Bitcoin’s potential.

The ongoing discussions surrounding Bitcoin reserves comes at a time when cryptocurrencies are beginning to gain traction within broader economic and regulatory conversations. With U.S. policymakers contemplating how to navigate and regulate this quickly evolving landscape, the idea of a federal Bitcoin reserve could signal a drastic policy shift. This move would not only elevate Bitcoin’s status but also pave the way for other cryptocurrencies to be recognized and often integrated into traditional financial systems.

In addition, commentators like David Bailey have lauded Trump’s advocacy for Bitcoin, arguing that strategic policy implementations could solidify America’s position as a dominant player in the cryptocurrency arena. Bailey’s cautionary stance toward certain trends, like Trump’s new memecoin venture, balances the positivity surrounding potential pro-Bitcoin policies while indicating there is still much ground to cover.

The days and weeks following Trump’s inauguration will be critical as the nation watches for indicators of policy directions regarding digital currencies. As speculation mounts and the crypto community unites around shared ambitions, the prospect of a Strategic Bitcoin Reserve highlights not just a pivotal moment in Bitcoin’s history, but also a potential transformation in how governments engage with emerging financial technologies. The unfolding narrative around Bitcoin under Trump, its advocates, and potential regulations underscores an exciting yet cautious phase in the cryptocurrency’s evolution and invites investors to keep a vigil on further developments.

Leave a Reply