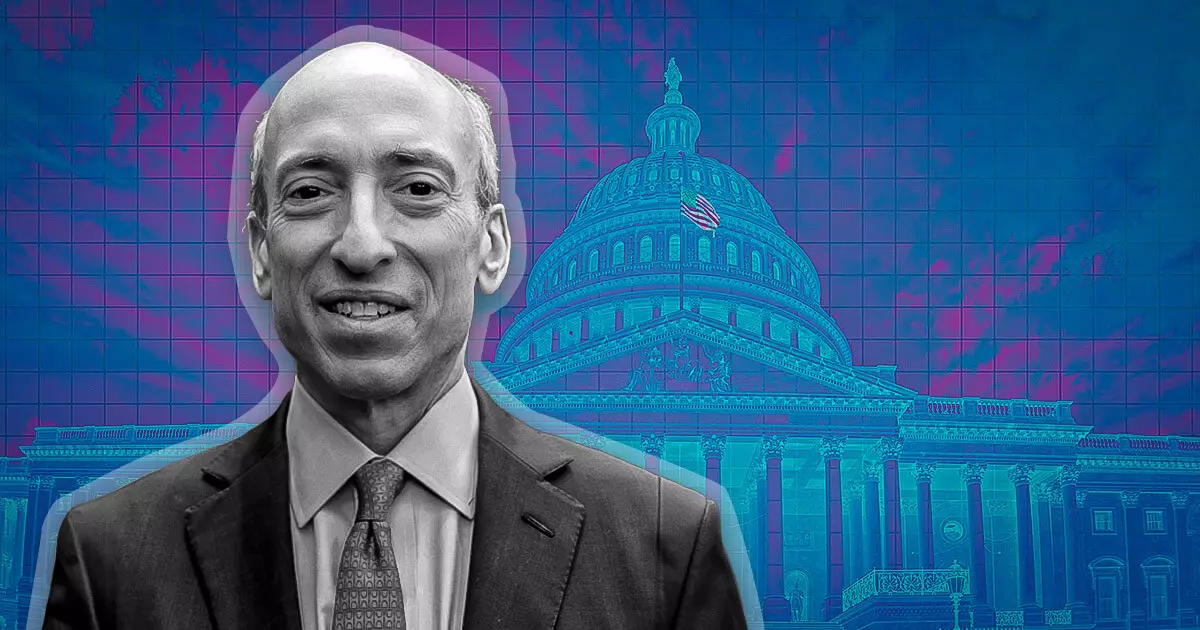

The role of the U.S. Securities and Exchange Commission (SEC) and its leaders often draws scrutiny, particularly as it pertains to the volatile landscape of cryptocurrency. Recent comments from Tyler Winklevoss, co-founder of the cryptocurrency exchange Gemini and former Olympic rower, have thrust SEC Chair Gary Gensler into the spotlight amidst growing allegations of misconduct and overreach. Winklevoss’s assertions reflect a broader discontent among cryptocurrency advocates regarding the SEC’s approach to regulation, encapsulating both the fear and frustration of a community that feels increasingly threatened by government actions. This article profoundly analyzes the conflict between Winklevoss’s criticisms and Gensler’s regulatory strategies while exploring the implications for the broader financial ecosystem.

In a passionate post on social media platform X, Winklevoss expressed vehement dissatisfaction with Gensler’s actions, asserting that they are “not good faith mistakes” but rather “entirely thought out, intentional, and purposeful.” Winklevoss’s characterization of Gensler as “evil” indicates a deep-seated belief that regulatory decisions are being made with ulterior motives, specifically to advance a personal or political agenda. This accusation goes beyond simple disagreement with policy; it suggests a betrayal of public trust at the highest levels of government.

According to Winklevoss, Gensler’s approach has catastrophic consequences, including the potential dismantling of the cryptocurrency industry and its associated jobs. He stresses that the actions taken by Gensler “nuked” an industry, implying that while regulations are necessary, the manner in which they are being enforced may inadvertently harm rather than protect. The stakes are high not only in terms of public trust but also in the realm of significant financial investments.

Winklevoss’s sentiments are not an isolated perspective. Many in the crypto community echo these frustrations, suggesting that Gensler’s style of “regulation through enforcement” is damaging to innovation and progress. The SEC, which is designed to protect investors and maintain fair markets, is facing criticism for a perceived overreach in regulating a sector that operates at the cutting edge of technology and finance. This growing apprehension culminated in a recent lawsuit filed by 18 U.S. states against the SEC, claiming “gross government overreach” in its dealings with crypto businesses.

Statements by political figures, including the mention of Republican President-elect Donald Trump’s promise to dismiss Gensler on his first day back in office, bolster the narrative that dissent against the SEC’s strategies is gaining traction beyond the industry. Such developments suggest a potential shift in regulatory philosophy that could reshape the SEC’s role in emerging financial markets.

As debates continue over Gensler’s leadership, Winklevoss advocates for a complete rejection of any collaboration with him post-SEC, suggesting that entities hiring Gensler betray the crypto industry. This call for a boycott indicates a level of division that transcends mere policy disagreement, hinting at a fundamental clash between traditional financial regulation and the revolutionary nature of cryptocurrencies.

The implications of Gensler’s tenure and the surrounding controversies extend far beyond personal reputations; they have the potential to impact the regulatory landscape for years to come. With his term lasting until July 2025, the urgency for dialogue over the appropriateness of his proposed regulations will only intensify. It raises the crucial question of how effectively the SEC can balance its mandate to protect investors while fostering innovation in a rapidly evolving financial sector.

The discourse surrounding Gary Gensler’s leadership of the SEC exemplifies the growing pains of an industry at the intersection of innovation and regulation. As both supporters and detractors voice their opinions, it becomes increasingly evident that the spirit of entrepreneurship in the crypto space is facing significant headwinds from regulatory machinations. The ongoing battle over regulatory frameworks will likely linger, and as stakeholders navigate these turbulent waters, the ramifications will be felt across the financial landscape. The question remains: can the SEC adapt its approach to better support innovation while maintaining the integrity of investor protection? Only time will tell, but the urgency for reform is palpable, as voices like Winklevoss’s grow louder in their calls for change.

Leave a Reply