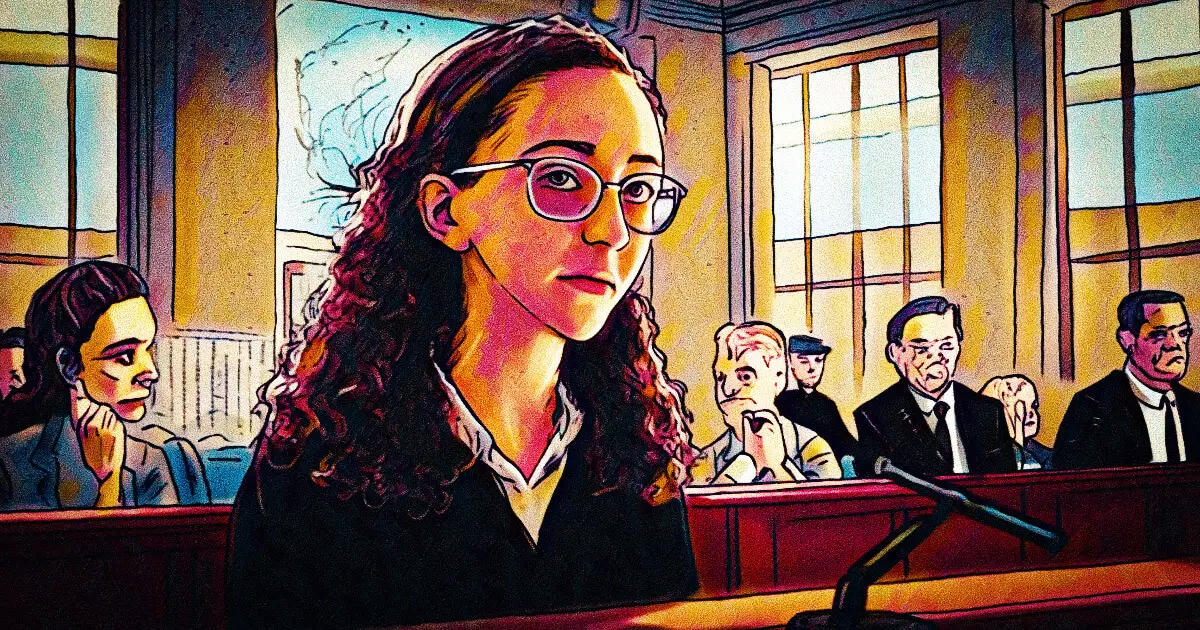

The downfall of the FTX cryptocurrency exchange represents one of the most shocking events in financial history, and at the center of this turbulent narrative is Caroline Ellison, the former CEO of Alameda Research. Recently sentenced to two years in prison and ordered to forfeit $11 billion, Ellison’s case stands as a compelling examination of the complex intersections between personal relationships and corporate governance in the rapidly evolving crypto landscape.

Despite Ellison’s significant cooperation with federal authorities, which played a pivotal role in securing the conviction of her ex-boyfriend, Sam Bankman-Fried (SBF), her plea for leniency did not deter the court from imposing a harsh sentence. Her legal team’s arguments hinged on her pivotal testimony during SBF’s trial and her return to the United States from the Bahamas. While these factors showcased her willingness to assist in the recovery of funds mismanaged by FTX, they proved insufficient to absolve her of accountability for her actions.

The judge’s decision reflects an underlying message: cooperation is valuable but does not absolve individuals from responsibility when catastrophic failures occur at the executive level. Prosecutors highlighted the severe implications of her role in the conspiracy and financial fraud that led to FTX’s spectacular collapse, asserting that shedding light on malfeasance does not negate the damage caused.

Ellison’s lawyers argued that she was acting under significant influence due to her close personal relationship with SBF, suggesting that her moral compass was severely compromised. This argument opens a broader discussion about the ethical dimensions of leadership within corporate environments, particularly in high-stakes sectors like cryptocurrency. The claims illustrate how personal dynamics can cloud judgment, especially in scenarios characterized by deception and financial impropriety.

The ramifications of this case extend beyond Ellison and SBF, affecting the broader cryptocurrency ecosystem that had once thrived on innovation and trust. FTX’s meteoric rise and subsequent fall have left thousands of investors in disarray, raising questions about regulatory oversight and the need for more robust governance frameworks in this unregulated marketplace.

Ellison’s sentence is only one part of a larger narrative involving the former executives of FTX. The legal consequences facing other leaders within the company indicate a systemic issue that could reshape how cryptocurrency firms operate. With fellow executives like Nishad Singh and Gary Wang awaiting their turn in the courtroom, the implications of FTX’s collapse continue to ripple through the industry.

As the case unfolds, it serves as a grim reminder of the potential consequences of financial mismanagement and the importance of ethical leadership. Investigations and sentencing are likely to exert pressure for regulatory reform, as lawmakers grapple with how to prevent similar failures in the future. Ellison’s predicament encapsulates the inherent dangers present in ambitious ventures that lack oversight and accountability, shining a spotlight on the urgent need for a rigorous ethical framework in the crypto space.

The sentencing of Caroline Ellison underscores a crucial turning point in the burgeoning world of cryptocurrency, where individual decisions have far-reaching, sometimes devastating impacts on numerous stakeholders.

Leave a Reply