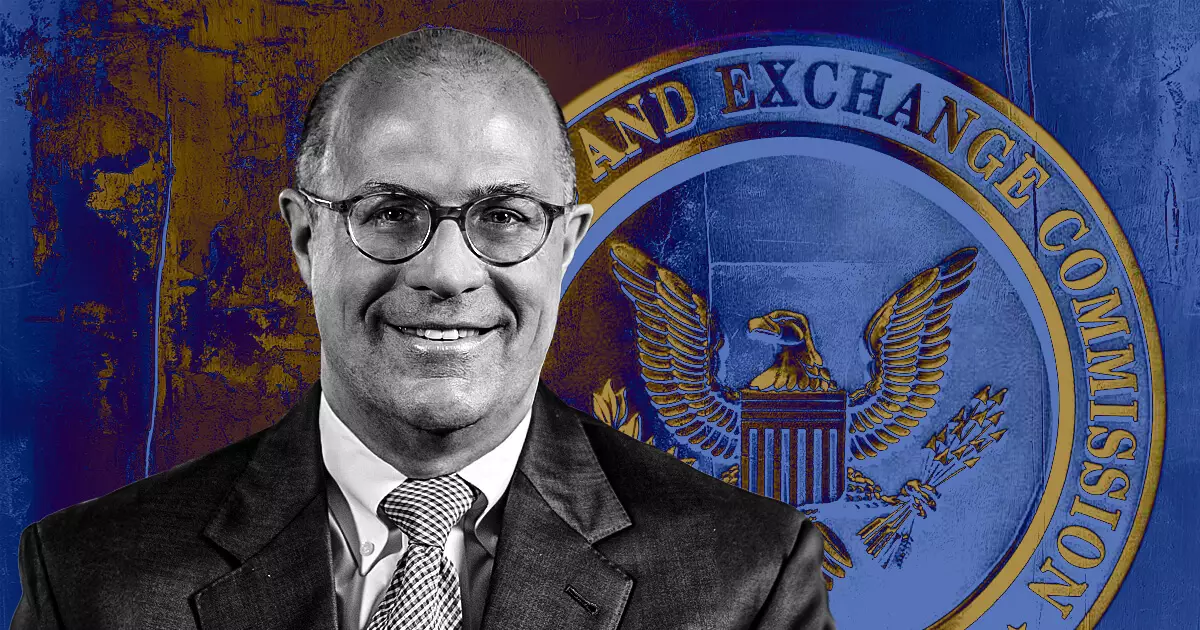

Former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo has recently addressed rumors regarding his consideration for a potential role as the next Chair of the U.S. Securities and Exchange Commission (SEC). In an assertive display, Giancarlo denied any interest in this position, as well as in a role related to cryptocurrency within the U.S. Treasury Department. His remarks signify a clear distance from these opportunities, particularly highlighting his previous experiences under current SEC Chair Gary Gensler. Giancarlo mentioned that he “cleaned up earlier Gary Gensler mess” at the CFTC and emphasized that he was not inclined to revisit such challenges.

The ‘mess’ Giancarlo referred to could be pointing towards the SEC’s controversial “regulation by enforcement” strategy towards the cryptocurrency sector. This has drawn criticism, even from within the regulatory team, as one commissioner labeled it a “disaster.” Giancarlo’s tenure at the CFTC from August 2017 allowed him to build a reputation as a proponent of cryptocurrency, earning him the nickname “Crypto Dad.” His statements from 2018 heralding the permanence of cryptocurrencies stand in stark contrast to Gensler’s current aggressive regulatory posture.

Since taking the SEC’s reins in 2021, Gensler has adopted a hardline approach to digital assets. Recently, he defended this strategy during a speech at the Practising Law Institute’s annual securities regulation conference. Gensler reiterated that while Bitcoin does not qualify as a security, numerous other cryptocurrencies likely do fall under this classification. This perspective necessitates stringent standards for sellers and intermediaries within the crypto space, setting the stage for robust regulatory measures aimed at safeguarding investors.

Gensler’s assertion that inadequate oversight of digital assets could lead to “significant investor harm” underscores a broader concern within the regulatory community. Historical instances of failed cryptocurrencies lacking utility or stability further justify the SEC’s cautious and vigilant stance. The narrative is clear: without proper regulation, the nascent sector might expose unwary investors to unnecessary risks.

Since Gensler’s arrival, the SEC has ramped up its enforcement actions against prominent crypto firms, including Kraken, Binance, Ripple, and Coinbase. This aggressive strategy has not gone unnoticed. Critics argue that the SEC’s approach lacks coherence and that the absence of clear guidelines has created a hostile environment for innovation within the crypto market.

Giancarlo’s approach distinctly contrasts with Gensler’s vision. Whereas Giancarlo has historically fostered growth and innovation in the crypto domain, Gensler’s regulatory framework appears more preoccupied with oversight and compliance, leaving many industry stakeholders anxious about the future.

As debates continue over the best path to ensuring investor protection in the rapidly evolving cryptocurrency sector, the roles of leaders like Giancarlo and Gensler will remain pivotal. Their differing ideologies reflect the larger struggle between fostering innovation and ensuring regulatory safety within the financial landscape. The path forward for cryptocurrencies in the U.S. will undoubtedly hinge on how navigators of policy can reconcile these conflicting perspectives.

Leave a Reply