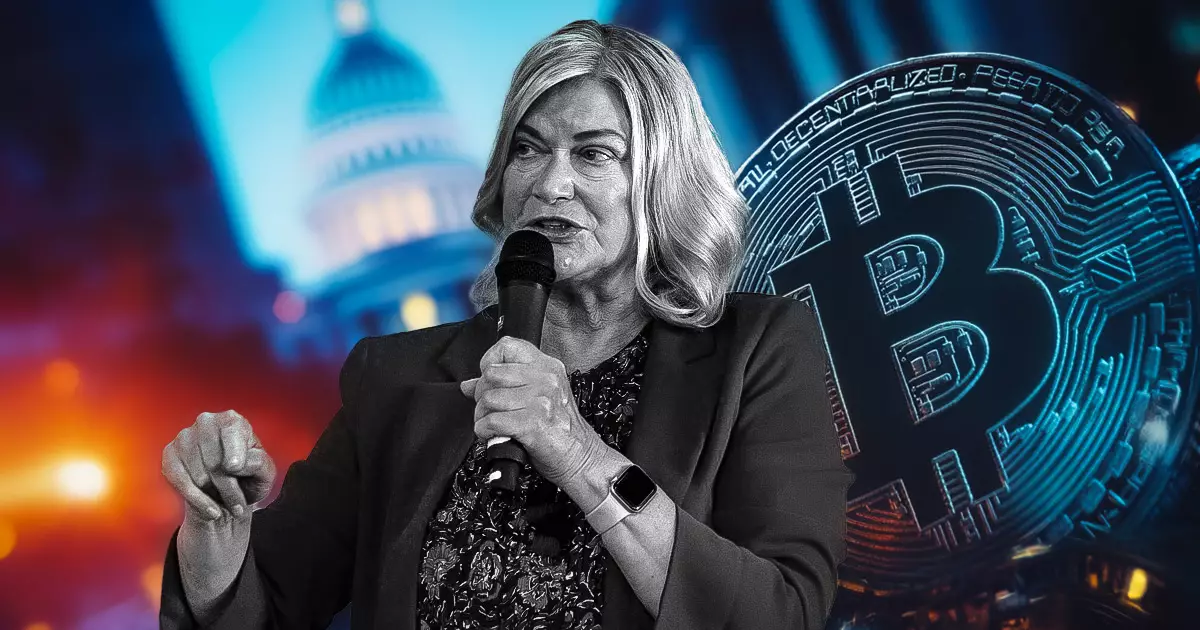

In a pivotal move for the future of digital assets in America, Senator Cynthia Lummis (R-Wyo.) has been appointed as the inaugural chair of the newly formed Senate Banking Subcommittee on Digital Assets. Announced on January 23, this development signifies a crucial step forward in creating a comprehensive regulatory framework for blockchain technology and cryptocurrencies. Stakeholders in the financial technology sphere are watching closely as the Senate Banking Committee, under Chair Tim Scott (R-S.C.), gears up for what could be transformative initiatives in American finance.

Lummis, a vocal advocate for Bitcoin (BTC), has reiterated her belief that digital currencies present unprecedented opportunities for economic advancement. In her statement upon receiving this role, she underscored the urgency of Congress taking legislative action to secure the United States’ position as a frontrunner in the evolving world of digital assets. “Digital assets are the future,” she asserted, emphasizing that failing to enact bipartisan legislation could jeopardize the economy in light of global financial innovations.

Lummis’s vision includes proposing a national reserve of Bitcoin, which she believes could significantly bolster the US dollar’s standing on the global stage. This ambitious proposal was notably presented in her Bitcoin Act legislation during the Bitcoin 2024 conference held recently in Nashville. The implications of such a reserve could position the United States as a pioneer in cryptocurrency regulation and usage, potentially inspiring similar frameworks worldwide.

The subcommittee is expected to prioritize vital issues, including market structure, stablecoins, and protections for consumers engaging with digital assets. Furthermore, it will oversee various federal financial regulators to ensure compliance with impending legislation and guard against overreach by regulatory bodies, commonly referred to in the industry as “Operation Chokepoint 2.0.” This vigilance is critical for fostering innovation while simultaneously protecting consumers and investors from potential market distortions.

The composition of the subcommittee reflects a bipartisan approach, featuring Senators from both sides of the aisle, including Thom Tillis (R-N.C.), Bill Hagerty (R-Tenn.), and Tina Smith (D-Minn.), among others. With Ruben Gallego (D-Ariz.) serving as the ranking member, the roster indicates a concerted effort to collaborate across political lines and establish a framework that serves all Americans, regardless of political affiliation.

The industry response has been overwhelmingly positive. Advocates, including Dennis Porter, co-founder and CEO of Satoshi Action Fund, have heralded Lummis’s appointment as a significant advancement toward meaningful legislation that could strengthen the digital asset ecosystem. Similarly, former Binance CEO Changpeng Zhao emphasized the potential impact of a US Bitcoin reserve, acknowledging the rapid pace at which cryptocurrency developments are taking shape.

As this subcommittee embarks on its mission, the effects of its deliberations and subsequent legislation will likely extend well beyond the borders of the United States. With Lummis at the helm, there is optimism that the US can pioneer a balanced regulatory approach that encourages technological advancement while ensuring robust consumer protections. This dual focus may moderate skepticism surrounding digital assets and position the country favorably amidst global competition in the financial innovation landscape.

Ultimately, the actions of this committee will play an instrumental role in shaping the future of digital assets and reinforcing the US’s aspiration to remain at the forefront of financial innovation.

Leave a Reply