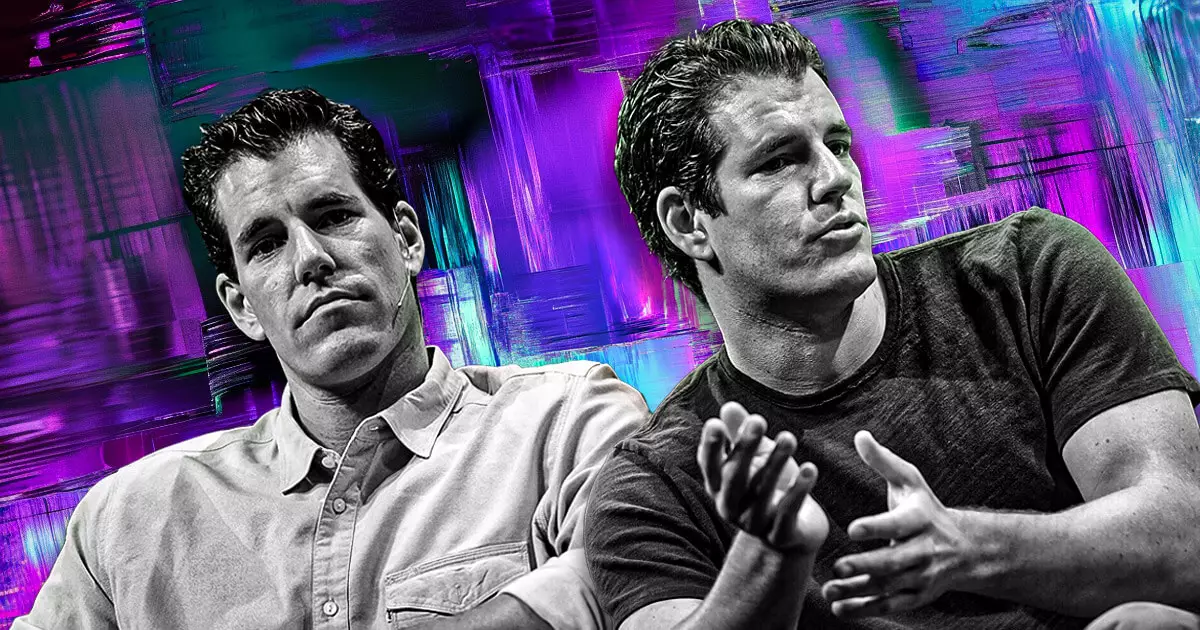

Gemini, a prominent cryptocurrency exchange founded by the Winklevoss twins, is reportedly weighing the benefits of an initial public offering (IPO) in the near future, as suggested by various insiders. While these discussions around a public listing seem promising, the lack of a definitive conclusion emphasizes the complexity and uncertainty enveloping many cryptocurrency firms today. The exchange’s leadership has yet to place a formal announcement, indicating that it is still in the exploratory phase as it assesses market conditions and regulatory environments.

Political Climate Influences on Crypto

A significant factor in Gemini’s potential IPO is the political landscape in the United States. According to Bloomberg ETF analyst James Seyffart, the pro-crypto stance of the previous Trump administration may encourage a wave of IPOs from cryptocurrency firms over the next two years. This shift could stem from an increased desire among crypto entities to establish themselves in the mainstream financial milieu. Furthermore, the Winklevoss twins’ financial contributions to Trump’s campaign, despite technical violations of donation caps, underscore the intertwining of cryptocurrency and politics, highlighting the strategic moves within the industry to gain favor and legitimacy.

Regulatory Hurdles and Strategic Shifts

Gemini’s IPO ambitions come in the wake of significant regulatory challenges that have plagued the firm. Earlier this year, the exchange agreed to pay a hefty $5 million settlement related to accusations from the Commodity Futures Trading Commission (CFTC). The lawsuit alleged that Gemini misled regulators during efforts to launch the first U.S.-regulated Bitcoin futures contract. This experience has undoubtedly shaped their strategic direction, indicating that Gemini is trying to clarify its operational compliance amidst a turbulent regulatory landscape.

As Gemini reconfigures its business model, recent steps illustrate the exchange’s proactive measures to adapt. The decision to withdraw from the Canadian market follows in the footsteps of other exchanges like Bybit and Binance, highlighting the growing challenges faced by crypto firms within specific jurisdictions. Conversely, Gemini’s recent license acquisition in Singapore places it in a favorable position, enabling cross-border money transfers and digital payment services within a country known for its progressive crypto policies. This approach aligns with broader trends, as other firms—like OKX and Coinbase—also pivot towards jurisdictions that embrace digital currencies.

The emerging trend of crypto IPOs could signal a transformative era for multiple digital asset exchanges. Companies including Bullish Global, backed by notable investors, are also contemplating public offerings. As the market navigates through heightened regulatory scrutiny and competition, firms must carefully consider both their operational strategies and public reception. Gemini’s path forward will not only reflect its internal resolutions but also the broader acceptance of cryptocurrencies in traditional financial systems. Ultimately, the success of any future IPO will depend on the ability to balance innovation with compliance while responding to an ever-evolving market and landscape.

While the prospect of an IPO presents a lucrative opportunity for Gemini, it is fraught with complexities that necessitate careful deliberation. The exchange’s journey mirrors the larger narrative within the cryptocurrency ecosystem—a world that is continually adapting to shifting regulations, competitive pressures, and a growing demand for legitimacy.

Leave a Reply