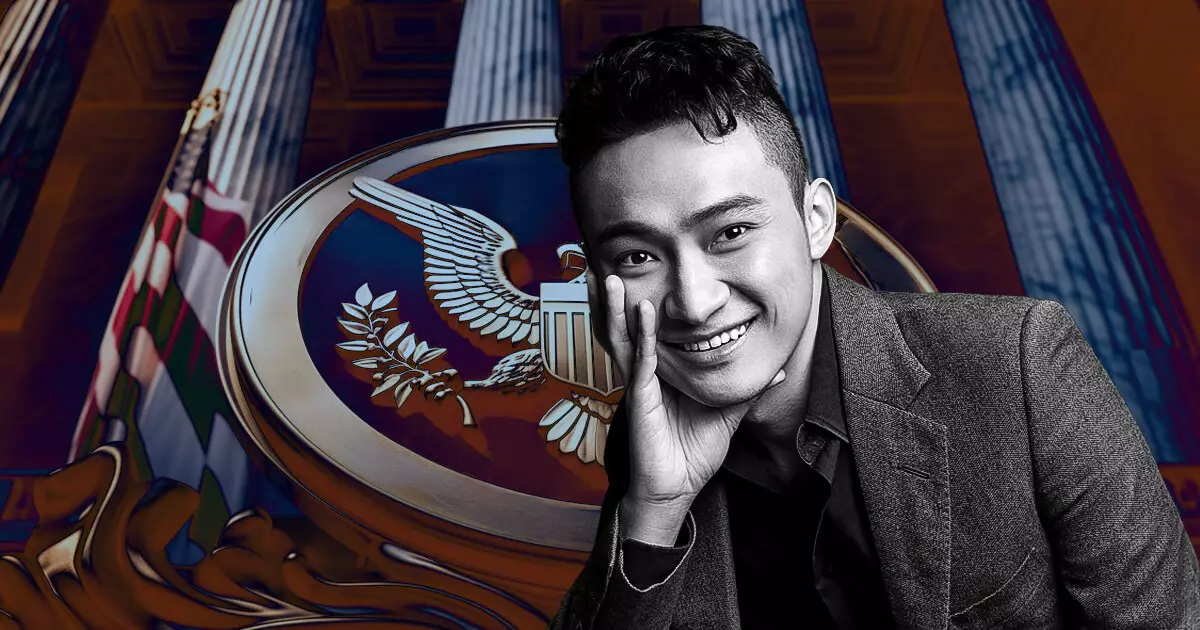

The recent filing of an amended complaint by the US SEC against Justin Sun and other defendants on April 18 raises questions about the jurisdictional basis for pursuing legal action. The SEC argues that Sun’s alleged visits to the US should grant it the necessary jurisdiction to proceed with the case. The regulator claims that Sun spent over 380 days in the US between 2017 and 2019, conducting business trips to major cities such as New York City, Boston, and San Francisco on behalf of the Tron Foundation and BitTorrent Foundation. The SEC is using these visits as a basis for claiming jurisdiction over Sun and the companies involved in the unregistered offers and sales of BTT and TRX tokens.

One of the key allegations in the amended complaint is the involvement of Sun and the companies in a wash trading scheme on the now-defunct crypto exchange Bittrex. While the original complaint mentioned similar wash trading activities, it did not specifically name the exchange where the activities took place. By now identifying Bittrex as the platform involved in the wash trading scheme and highlighting its US-based operations, the SEC strengthens its case for personal jurisdiction over Sun and the other defendants.

The amended complaint also brings to light Sun’s personal communication with and provision of documents to Bittrex in 2018 to facilitate the listing of the TRX crypto on the exchange. These documents not only link Sun to the companies implicated in the case but also show his active involvement in the process. By establishing this direct communication and collaboration with a US-based entity, the SEC further establishes a connection to the jurisdictional claims against Sun.

In response to Sun’s request to dismiss the SEC case in March due to a lack of personal jurisdiction, the amended complaint directly addresses the arguments put forth by the defense lawyers. While Sun’s legal team argued that he is a foreign national and not “at home” in the US, the SEC uses his extensive visits and communications with US-based entities to counter this claim. Additionally, the SEC refutes the defense’s assertion that there is no evidence of US residents purchasing TRX on the unidentified trading platform by highlighting Bittrex’s location and Sun’s direct involvement in the listing process.

The SEC’s legal action against Sun and the other defendants dates back to March 2023, with claims centered around investor focus in the Southern District of New York and celebrity promoters contacting individuals in the US via social media. The subsequent lawsuit against Bittrex in April 2023 further solidified the SEC’s position, leading to a settlement in August 2023. The eventual halt of Bittrex’s global operations in late 2023 adds a layer of complexity to the legal timeline and the implications of the SEC’s actions.

The amended complaint filed by the US SEC in the case against Justin Sun and other defendants underscores the regulator’s determination to establish jurisdictional grounds for pursuing legal action. By leveraging Sun’s visits to the US, communication with US-based entities, and alleged involvement in wash trading schemes on US platforms, the SEC strengthens its position in the case. The legal timeline and response to dismissal requests highlight the ongoing legal battle and the complexities surrounding jurisdiction and international transactions in the crypto space.

Leave a Reply