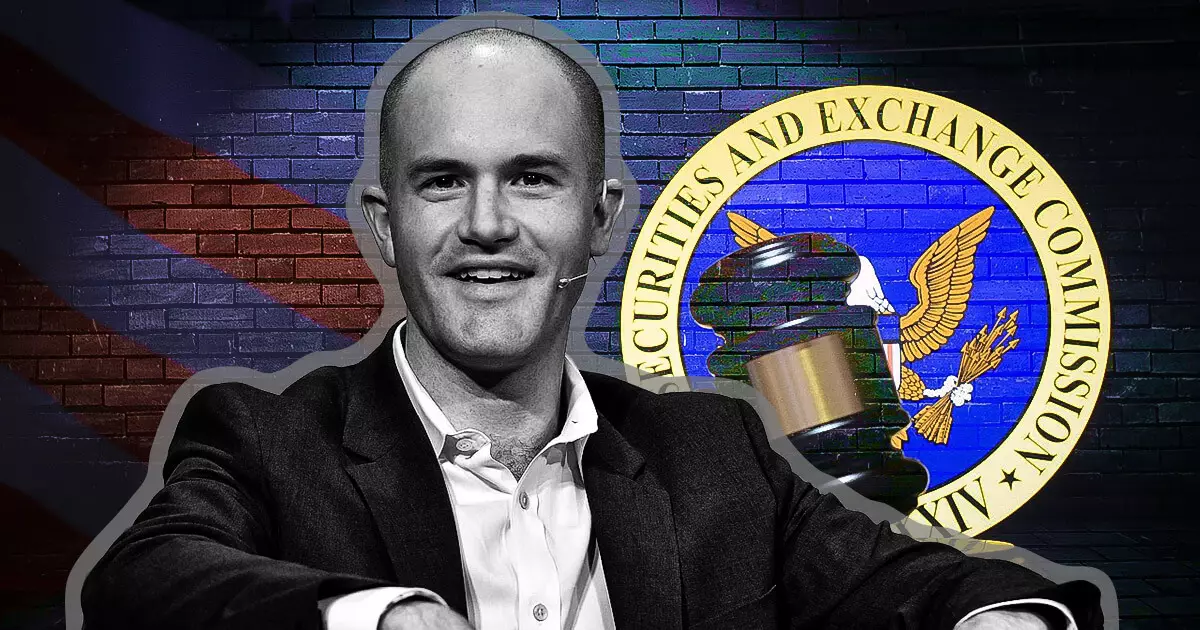

On December 3, 2023, Brian Armstrong, the CEO of Coinbase, made a significant announcement regarding the company’s legal partnerships, directly addressing the contentious relationship between the cryptocurrency sector and regulatory authorities. Armstrong’s decision to cut ties with law firms employing former regulators was an assertion of the crypto industry’s growing frustration with what many perceive as punitive and unclear regulatory practices. This move, prompted by Gurbir S. Grewal’s recent appointment at Milbank, signals a shifting dynamic in how cryptocurrency businesses are willing to engage with legal professionals associated with regulatory actions they deem harmful.

Armstrong’s comments reflect the ongoing tensions rooted in the history of regulatory enforcement against cryptocurrency platforms. Under the leadership of former SEC chair Gary Gensler, the SEC was criticized for its aggressive stance toward digital assets, leading to a slew of enforcement actions that many in the industry regarded as overreach. Armstrong’s insistence that law firms hiring individuals like Grewal—whom he accused of actively participating in the regulatory crackdown—should be seen as a warning signal to the broader legal community. It emphasizes that the exchange will no longer support entities that align themselves with practices perceived as damaging to innovation within the crypto space.

Armstrong’s statement raises essential questions about accountability within the regulatory framework. He contends that regulators, particularly those in senior positions, have a responsibility to recognize the implications of their actions on emerging technologies. His assertion that being merely “following orders” is insufficient accountability for those in such roles suggests a call for more ethical governance in regulatory practices. He urges legal and regulatory professionals to consider their role in shaping policy that supports rather than stifles innovation, advocating for a more transparent and collaborative approach.

The ramifications of Armstrong’s decision extend beyond Coinbase; it highlights a potential paradigm shift in which companies may increasingly evaluate their partnerships through the lens of regulatory history and ethical considerations. By encouraging other firms to take a stand against former regulators like Grewal, Coinbase is not only positioning itself as a leader in the crypto industry but also encouraging a collective resistance against regulatory malpractice. This could lead to a wider movement among cryptocurrency firms to demand clearer guidelines that promote innovation rather than stagnation.

A Call for Unity in the Face of Opposition

In his remarks, Armstrong notably draws attention to the principle of temporary cancellation rather than permanent exclusion. This subtle yet significant distinction invites dialogue within the crypto community about how best to navigate complex regulatory landscapes while fostering unity among stakeholders. He underscores that supporting individuals who have engaged in harmful regulatory practices could undermine the sector’s growth potential. Armstrong’s plea for law firms to reconsider their hiring practices reflects a growing consensus within the crypto industry: a call for solidarity in advocating for the future of digital finance.

Ultimately, Armstrong’s announcement serves as both a critique of past regulatory failures and a rallying cry for the cryptocurrency industry to take charge of its future. As the landscape continues to evolve, it remains to be seen how this approach will reshape the relationship between cryptocurrency firms, legal advisers, and regulators moving forward.

Leave a Reply