In the rapidly evolving landscape of cryptocurrency, Bitcoin has found itself at the center of attention, especially during the closing months of the past year and the early weeks of this year. Surging past the psychological barrier of $100,000, Bitcoin not only captivated investors but also set new all-time records. However, this exuberance was fleeting as it soon retreated into a tumultuous trading range marked by prices fluctuating between $92,000 and $106,000. Recently, this precarious equilibrium shattered dramatically, leading to a significant drop that sent prices plunging below the $80,000 threshold.

This decline wasn’t just a random event; it coincided with a broader sell-off trend, marked by large holders, or “whales,” dumping substantial amounts of Bitcoin as selling pressure intensified. Such actions often signify a lack of confidence among major stakeholders, raising alarms for retail investors and leading to further instability in the market. Compounding these factors, both network activity and the hash rate saw marked reductions, painting a rather bleak picture for the cryptocurrency.

It’s critical to recognize that these tribulations in the crypto market did not occur in isolation. The global economy is experiencing a painful phase of adjustment, influenced by various macroeconomic factors including escalating reforms from a decidedly active political administration in the United States. Such shifts ripple through financial markets, causing declines across asset classes—illustrated by the NASDAQ Composite, which faced a 3.5% drop in one week, alongside a significant decline in gold futures.

Additionally, for the first time in two years, data indicated a downturn in consumer spending in the U.S., suggesting that household confidence might be wavering. By drawing a connection between this macro backdrop and the troubles faced by Bitcoin, it becomes clear that the cryptocurrency is not merely suffering from internal market dynamics, but is also a victim of larger economic currents.

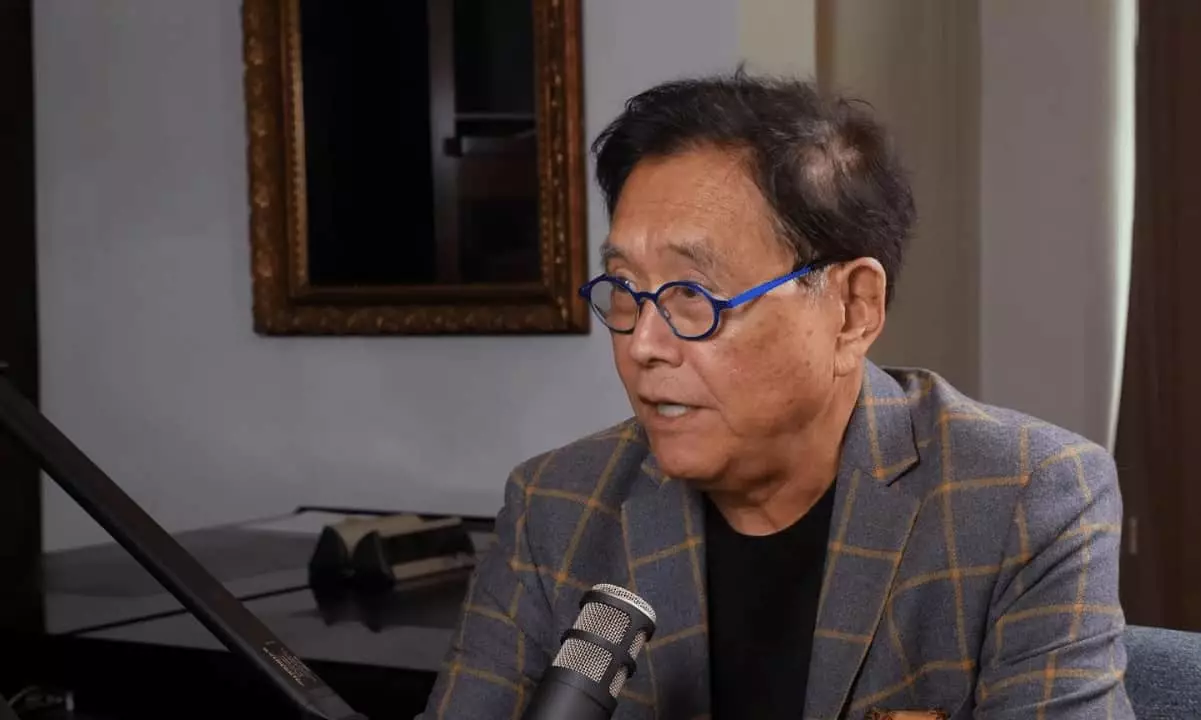

Yet, not all analyses point toward doom and gloom. Prominent figures in the financial sector, like Robert Kiyosaki and various blockchain market analysts, are expressing optimism. Kiyosaki’s recently voiced belief that “Bitcoin is on SALE” echoes the sentiment among those who understand Bitcoin as a hedge against traditional financial systems plagued by systemic issues. The author of “Rich Dad, Poor Dad” argues that the true problems reside within the monetary mechanisms themselves, not the asset that many have come to trust.

Amidst all this, BitMEX founder Arthur Hayes projected another wave of volatility, possibly leading Bitcoin back down to $80,000. Surprisingly, this prediction coincided with Bitcoin’s bounce back from a low around $78,200, rising back above $86,000 in a matter of days. This recovery was accompanied by a surge in trading volume and an uptick in social media discussions surrounding the notion of “buying the dip,” suggesting that fears may have led to excessive selling, thus inviting a wave of bullish interest.

As the Bitcoin community braces for what may come next, it’s worth exploring whether the recent turmoil has ultimately reinforced the asset’s resilience. While short-term challenges loom, many anticipate that the intrinsic value of Bitcoin, rooted in its integrity as “money,” might lead to a renewed bullish sentiment as fear subsides. The battle between bears and bulls will undoubtedly rage on, but if history repeats itself, Bitcoin may yet prove its naysayers wrong and emerge stronger than before.

Leave a Reply