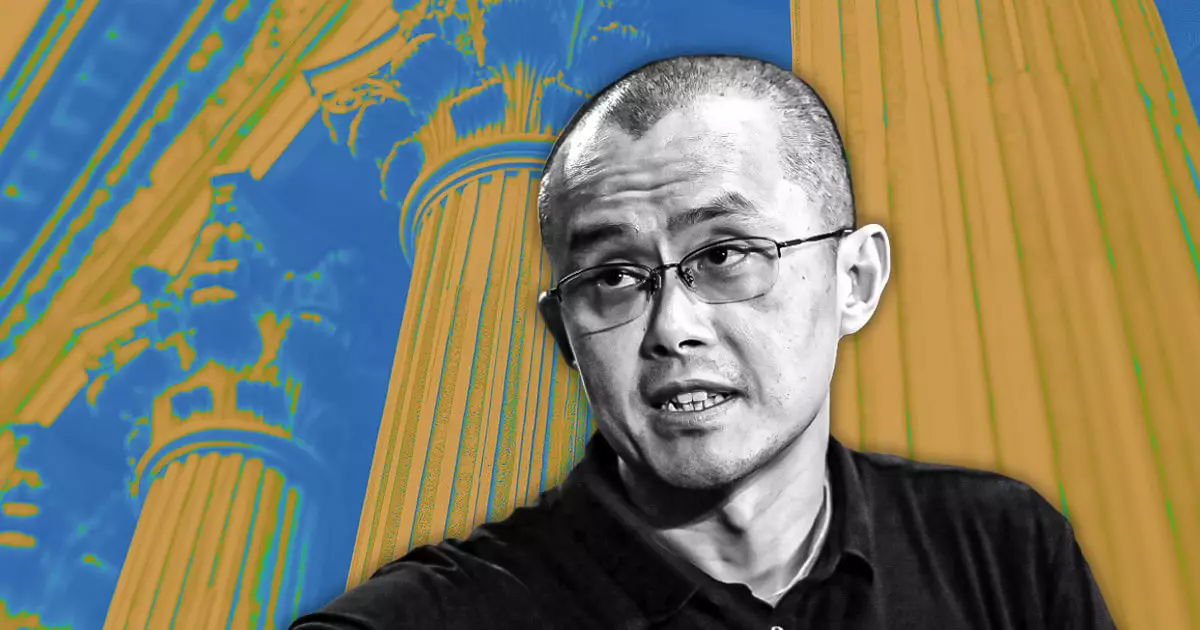

In a recent social media announcement, Changpeng Zhao, the founder and former CEO of Binance, firmly denied rumors that the leading cryptocurrency exchange was on the brink of being sold. The speculation had circulated across various platforms, primarily triggered by significant movement in the exchange’s asset holdings, which some users misinterpreted as impending asset liquidations. Zhao was quick to label these claims as “misinformation,” asserting they originated from a competitive rival in Asia. He emphatically dismissed the rumors, suggesting they were a form of baseless fear-mongering intended to undermine Binance’s credibility.

While firmly rejecting the possibility of a complete sale, Zhao signaled openness toward inviting outside investment in the form of minority stakes. He noted that top-tier investors have consistently shown interest in Binance, hinting at a future where selective investments might be welcomed. According to Zhao, the introduction of minor external investments—potentially in the lower single-digit percentage range—could occur as an avenue to bolster the exchange’s financial condition while still retaining control over its core operations.

Market Reactions and Clarifications

The confusion in the crypto community intensified following viral posts on Chinese social media that amplified the sale rumors, especially amidst ongoing regulatory challenges. This panic had significant implications, as many traders began reassessing their trust in the exchange and its financial stability. In response, Binance clarified that the changes in asset holdings were purely part of routine treasury management rather than indicative of a sale or an indication of financial trouble. The exchange assured users that their assets remained fully backed on a 1:1 basis, aiming to restore trust in its operations.

Navigating Regulatory Challenges

Despite the vibrant debates about ownership structures and market rumors, Binance stands tall as the world’s largest cryptocurrency exchange by trading volume. Every day, the platform processes transactions worth billions of dollars, showcasing its resilience in a sector that continues to evolve rapidly. Yet, the ongoing regulatory scrutiny presents challenges that the company must strategically navigate. Analysts suggest that the potential for minority stake sales could be a proactive measure, enhancing Binance’s financial robustness while preserving its autonomy.

Binance has traditionally enjoyed a privately held status, with Zhao maintaining a substantial share. However, the prospect of opening the gates to institutional investors could signify a watershed moment for the exchange, potentially reframing its operational landscape. If executed effectively, these minority stakes might not only shore up finances but also draw additional legitimacy and support from established players in the financial world.

Binance remains a formidable entity within the cryptocurrency ecosystem, undeterred by rumors of sale and actively seeking ways to adapt to a shifting market. As it contemplates minor investments and navigates the currents of regulatory challenges, the future of Binance holds considerable intrigue for both investors and crypto enthusiasts alike.

Leave a Reply