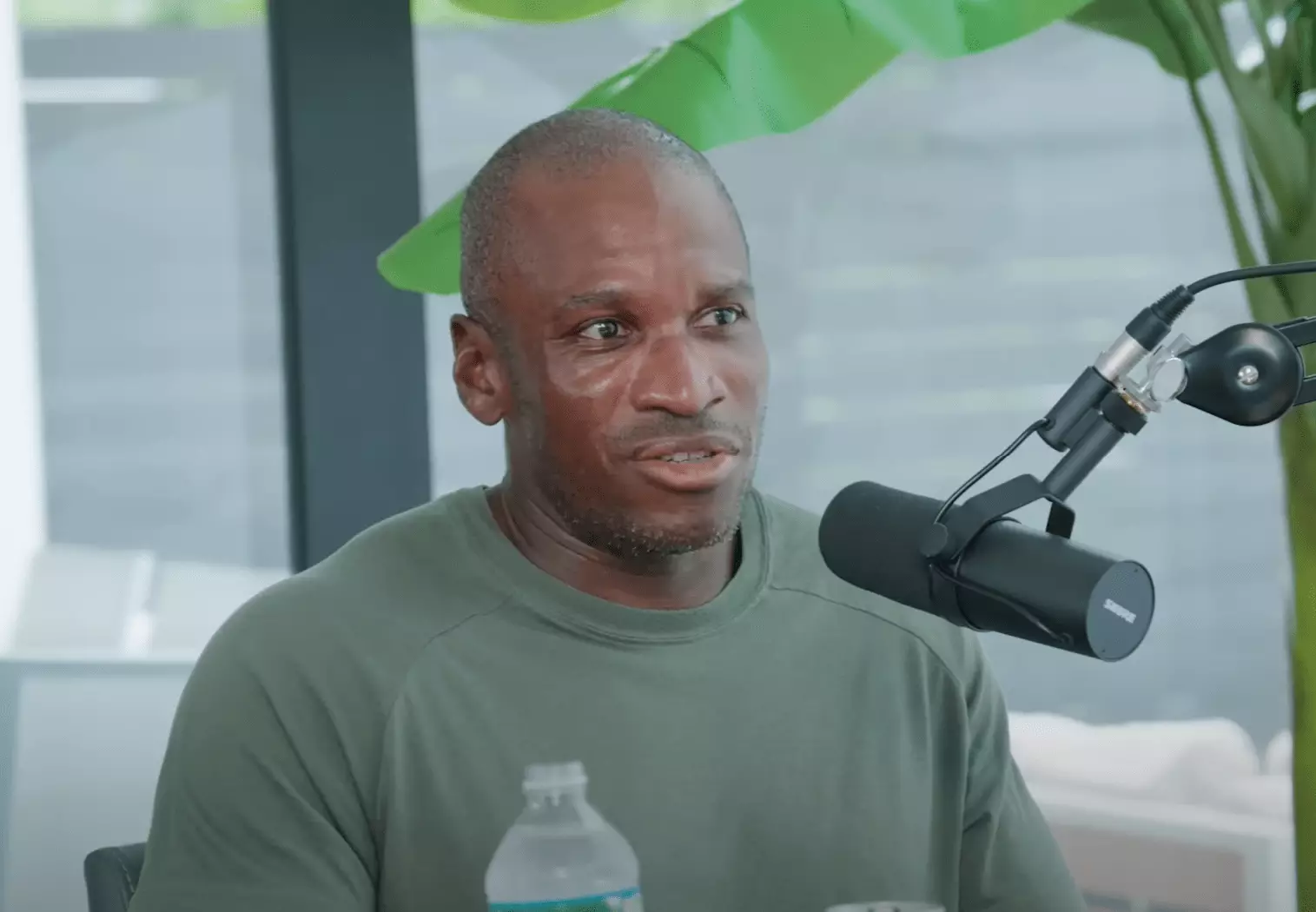

In the ever-evolving world of cryptocurrency, market analysis often oscillates between soaring optimism and stark pessimism. Arthur Hayes, the Chief Investment Officer at Maelstrom and the former CEO of BitMEX, has recently released an insightful essay titled “The Ugly.” In this piece, he articulates a candid overview of Bitcoin’s potential trajectory, blending technical analysis with broader economic indicators. Hayes contends that we may witness a significant pullback in Bitcoin’s price before it rallies to new heights, a claim that demands a deeper exploration of its implications.

Hayes begins his essay by reflecting on a sudden and disconcerting shift in market sentiment that took him by surprise. He draws an analogy between financial evaluations and backcountry skiing on a dormant volcano—pointing out how the slightest indication of danger can trigger a re-evaluation of one’s strategies. This sentiment is not merely anecdotal; it is deeply rooted in the fluctuations of financial indicators that, according to Hayes, mirror conditions preceding major downturns in late 2021. His intuitive unease prompts him to suggest that Bitcoin might experience a price correction to the $70,000-$75,000 range before embarking on a journey toward $250,000 later in the year.

The crux of Hayes’ argument revolves around the current “filthy fiat” environment that encompasses both equity and treasury markets. He identifies multiple leveraging factors—such as the dynamics of central bank balance sheets, banking credit expansion rates, and fluctuating treasury yields—that contribute to this complicated economic landscape. Specifically, Hayes posits that central banks, particularly the Federal Reserve, are navigating tricky waters as they raise interest rates or curtail monetary creation, which can suppress speculative capital essential for cryptocurrency and stock growth.

A potential 30% downturn, as Hayes predicts, appears increasingly plausible when contextualized against the backdrop of these ongoing monetary shifts. He set forth two scenarios: a price drop that allows for advantageous buybacks or a robust market movement beyond $110,000 allowing him to reinvest at elevated levels. The emphasis here is on capital preservation as a strategy—an astute approach during unpredictable market conditions.

A fascinating aspect of Hayes’ analysis is his examination of the interconnectedness of various global markets—or what he describes as a “tangle” of financial interests. He scrutinizes the correlations between Bitcoin, treasury yields, and equity markets, arguing that traditional financial frameworks are becoming increasingly insular. For instance, as yields rise, speculative investments in cryptocurrencies may retract, demonstrating a behavioral pattern tied to broader financial stability narratives.

Hayes also touches on the geopolitical dynamics at play, particularly the antagonistic relationship between the Federal Reserve and the Trump administration, which may influence economic policies moving forward. In particular, he insinuates that the Fed could take drastic measures should political pressure mount, thus weaving a narrative where financial markets could become entangled in political machinations that both regulate and destabilize them.

The crux of Hayes’ investment strategy is understanding market psychology. He emphasizes a protective stance that allows for observation and strategic movement in times of volatility. By prioritizing expected value over certainty, Hayes navigates the turbulent waters of cryptocurrency investment. The thinking here involves placing oneself in a position where, should an anticipated downturn occur, there are resources available to capitalize on the subsequent opportunities that materialize.

This perspective captures the essence of trading in modern markets: it’s less about making exact predictions and more about preparing for various potential outcomes based on plausible scenarios. Hayes’ “Armageddon” theory regarding altcoins illustrates this sentiment well; the anticipation of a market purge might provide a golden chance to buy undervalued but fundamentally robust tokens.

Arthur Hayes’s insights in “The Ugly” underscore the labyrinthine logic of cryptocurrency trading where market movements are often contingent on a myriad of factors—both economic and political. While some investors might be inclined to dive into optimistic narratives of skyrocketing prices, Hayes’ call for caution suggests a more calculated approach may be warranted. In the end, success in trading hinges on an appreciation for market complexities, the capacity to read sentiment, and the ability to adapt strategies in response to evolving scenarios. As we watch the cryptocurrency landscape transition, the foundations laid by essays like Hayes’ serve as critical touchstones for investors navigating the uncharted waters ahead.

Leave a Reply