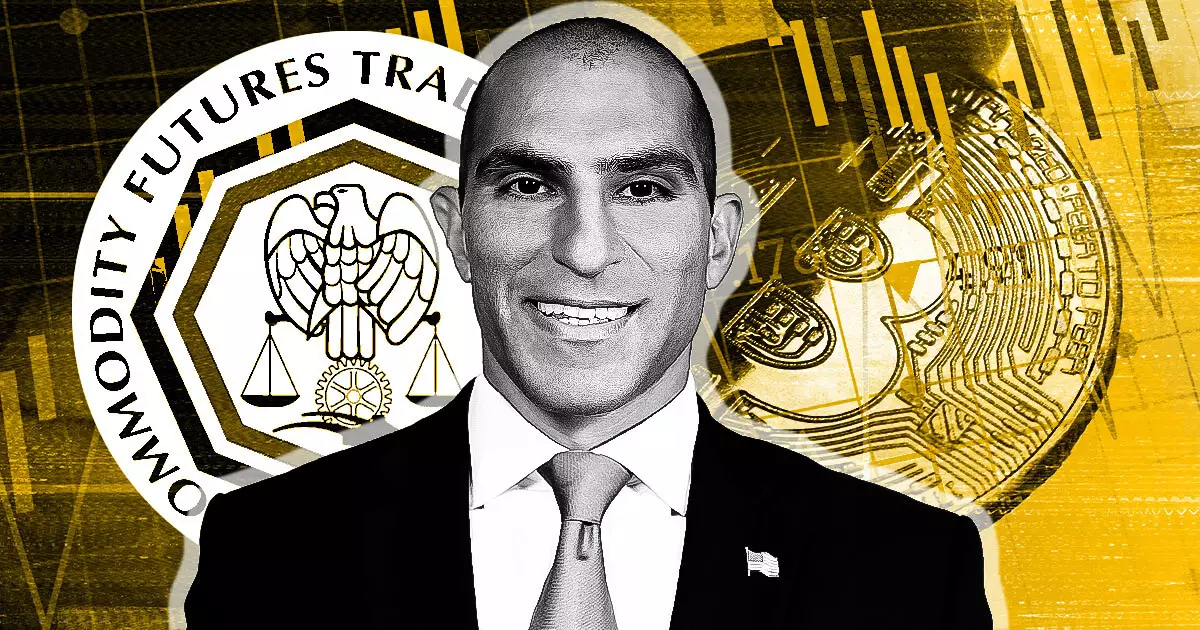

The statement made by CFTC Chair Rostin Behnam during the Senate Agriculture Committee hearing regarding the possibility of the CFTC serving as the primary regulator for digital assets raises significant questions about the current regulatory landscape. Behnam’s assertion that the CFTC has the capacity, expertise, and experience to take on this role is a bold claim that demands further scrutiny. While it is essential for regulatory bodies to adapt to the evolving nature of digital commodities, the implications of designating the CFTC as the primary regulator for crypto assets merit careful consideration.

Behnam’s remarks on the potential changes to the definitions of securities and commodities are crucial in understanding the implications of the CFTC assuming primary regulatory authority. The collaboration between the CFTC and the SEC in defining assets in grey areas over the past five decades highlights the complexity of regulating digital commodities. However, Behnam’s reluctance to support the SEC’s sole decision-making authority in this regard underscores the importance of establishing clear guidelines for regulatory oversight.

Legal Challenges and Contract Listing System

The concerns raised by Senator Marshall about potential lawsuits resulting from conflicting asset designations underscore the need for a comprehensive regulatory framework. Behnam’s acknowledgment of these challenges and the proposed contract listing system that aligns with the CFTC’s existing powers and fosters cooperation with the SEC reflect a pragmatic approach to addressing legal uncertainties in the crypto market. However, the effectiveness and feasibility of such a system remain subject to further examination.

Behnam’s emphasis on the importance of introducing tokens and contracts to regulated markets expeditiously to mitigate investor risks underscores the urgency of establishing a robust regulatory regime. His assertion that a significant portion of the crypto market should come under the CFTC’s purview due to its non-securities nature raises questions about the regulatory gaps in the current framework. The CFTC’s proposed budgetary requirements for establishing regulatory oversight and the reliance on user fees to offset funding indicate the financial challenges associated with regulating digital commodities.

CFTC Chair Rostin Behnam’s comments during the Senate Agriculture Committee hearing shed light on the complexities and challenges inherent in regulating crypto assets. While his advocacy for the CFTC to assume primary regulatory authority reflects a proactive approach to addressing the evolving digital commodities landscape, the implications of such a transition require careful deliberation. Collaborative efforts between regulatory bodies, clear guidelines for asset classification, and robust investor protection mechanisms are essential components of a comprehensive regulatory framework for the crypto market. Behnam’s remarks underscore the urgency of regulatory action to combat fraud and manipulation in the digital commodities space, emphasizing the need for swift and decisive measures to safeguard investors and uphold market integrity.

Leave a Reply