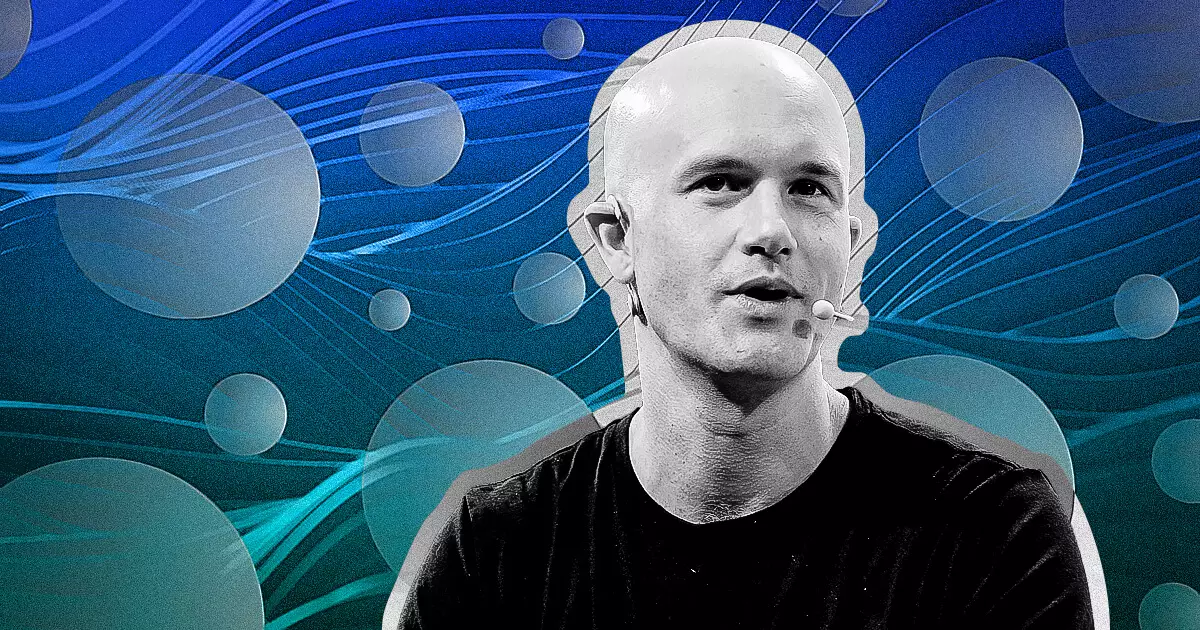

Brian Armstrong, the CEO of Coinbase, has recently highlighted an urgent need for reform in how cryptocurrencies are listed. His call to action resonates deeply within an industry experiencing surging innovation and a staggering increase in new tokens. Recent advancements in blockchain technology have led to an exponential proliferation of digital assets, with approximately one million new tokens emerging each week. Such rapid growth raises significant concerns regarding the efficacy of traditional evaluation mechanisms which have typically relied on painstaking individual assessments for token approval. These antiquated methods are proving inadequate in the face of a vibrant and expanding market that demands more agile and responsive frameworks for token evaluation.

One of the core issues Armstrong identified is the overwhelming influx of tokens created not just by established entities but also by individuals leveraging no-code solutions and automated token generators. This democratization of token creation allows even those without technical expertise to enter the crypto space, yet it simultaneously complicates the already intricate process of token assessment. The centralization of approval processes can no longer keep pace with the sheer number of new tokens, making it clear that the industry is at a pivotal crossroads. Armstrong aptly referred to the challenge as a “high-quality problem,” suggesting that, while the innovation is welcome, the methods of evaluation need a significant overhaul to remain relevant and efficient.

In response to these challenges, Armstrong has proposed an innovative block-list system aimed at revolutionizing how tokens are listed. Instead of evaluating tokens on an individual basis, this new system would operate on the premise that all tokens are deemed accessible by default. Tokens would only be blocked and flagged as harmful if they raised red flags through user feedback or automated scans of on-chain data. This method would considerably reduce the workload placed on regulatory bodies and allow the market to scale organically, with user engagement acting as a critical component in identifying risk factors.

Armstrong’s approach seeks to balance the need for security with the continuous drive for innovation, advocating for a user-centric model. This paradigm shift emphasizes accountability among users while simplifying the process of token evaluation, ultimately resulting in a more dynamic and responsive market.

One of the most pressing issues in the crypto market is the need for regulators to adapt their frameworks to the pace of innovation. Armstrong stressed that outdated systems are ill-equipped to manage the rapid evolution of the cryptocurrency landscape. He insists that both industry leaders and regulatory bodies must work in tandem to ensure that protective measures for investors do not stifle technological advancements. By fostering a collaborative relationship between the public and private sectors, Armstrong envisions a landscape where regulatory compliance and innovation can coexist in a balanced manner.

Armstrong’s comments also extended to Coinbase’s future direction, particularly the exchange’s commitment to enhancing decentralized exchange (DEX) functionalities. By streamlining both centralized and decentralized trading avenues, Coinbase aspires to create a seamless user experience that effectively blurs the lines between different trading methodologies. This ambition reflects a broader trend in the industry toward greater decentralization, indicated by Armstrong’s assertion that access to blockchain technology should be both intuitive and straightforward for all users.

Coinbase’s market position as a leading cryptocurrency exchange affords it considerable influence in shaping industry norms and practices. The strategies that Armstrong proposes not only contribute to user empowerment but also echo a commitment to transparency and security, underscoring the importance of adapting to an evolving ecosystem.

Brian Armstrong’s insights serve as a crucial guidepost for the cryptocurrency industry during this transformative moment. The proposed reforms in token listing processes and regulatory adaptations emphasize the need for a proactive and user-oriented approach to the rapid innovation characteristic of the crypto world. Armstrong’s vision presents an opportunity for industry stakeholders to rethink how they handle the influx of new tokens and adapt to an ever-changing landscape. Ultimately, as the digital asset market continues to mature, these reflections and proposals could define the trajectory of cryptocurrency policy and regulation for years to come.

Leave a Reply