Ethereum (ETH) finds itself in a precarious position as it fluctuates around the $2,565 mark, following a powerful rally that saw it breach resistance levels at $2,000 and $2,200. This surge represents a moment of optimism but also a warning that a corrective phase may be imminent. Analysts have now identified crucial price points, especially around the $2,400 level, where Ethereum’s next moves could dictate the course of its immediate financial future. For traders, this analysis isn’t just academic; it translates into real risks and opportunities, shaping decisions that could either augment wealth or exacerbate losses.

What has caused this sharp volatility? Simply put, it’s indicative of a market filled with exuberance and caution in equal measure. The substantial run-up in Ethereum’s price over the past week—surging more than 50%—has not been without its risks. With Open Interest in the derivatives market at extremely high levels, there’s an undercurrent of anxiety that warns of the consequences of such leverage. Essentially, a correction could not only be likely but also necessary for establishing stronger foundations moving forward.

The Role of Market Sentiment

Market sentiment plays a significant role in determining Ethereum’s trajectory. Currently, there’s a palpable optimism regarding an impending altcoin season, previously unheard of during the throes of bearish market conditions. Many industry experts hold the view that Ethereum’s recent bullish performance could act as a catalyst for a broader movement among altcoins that have long struggled. This intertwined relationship between Ethereum and other altcoins magnifies the stakes, turning cautious enthusiasm into a high-stakes game for traders and investors alike.

Nevertheless, this excitement is not without caveats. High levels of enthusiasm often produce high volatility, and that can lead to reckless behavior among traders. A pullback to $2,400, while perceived as a healthy consolidation, could just as easily give way to a deeper descent if not leveraged correctly. Market participants must carefully tread this swirling sea of sentiment—jubilance can quickly devolve into fear, emphasizing the importance of remaining grounded in analytical soundness rather than succumbing to speculative bubbles.

Technical Indicators: The Importance of Support Levels

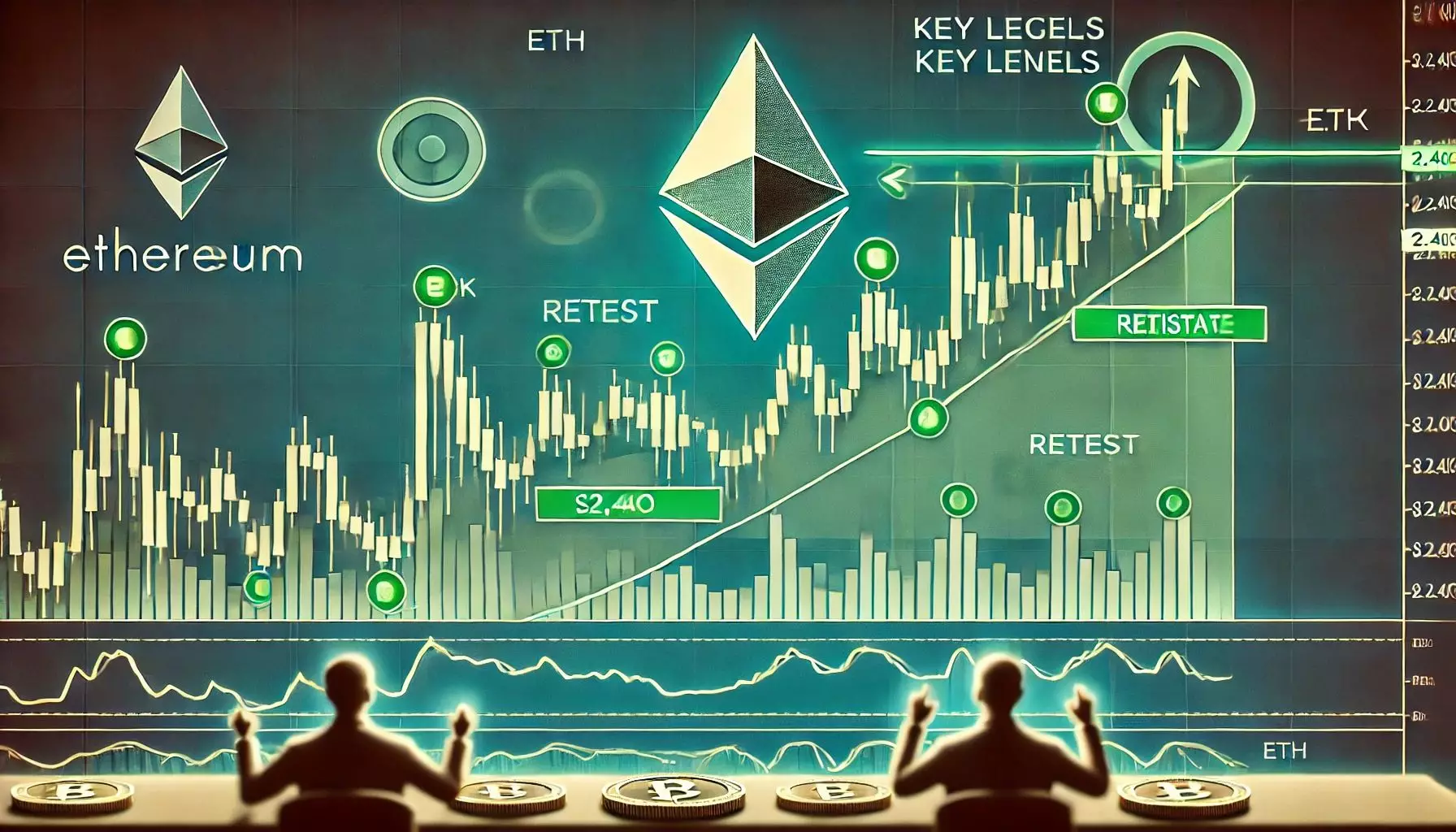

The discussion around Ethereum’s price is inherently tied to its various support levels, particularly those around $2,400 and $2,500. A crucial metric that many traders are closely watching now is the 200-day exponential moving average (EMA) and simple moving average (SMA), positioned near $2,702.93. If Ethereum’s price can manage to stay above these moving averages, it signals a sustained upward trend, keeping their bullish sentiment alive. However, any decisive break below the $2,400 level could easily shift the tide, marking a potential failure that could catalyze a more extensive reassessment of Ethereum’s bullish prospects.

Moreover, price structure becomes vital—are we witnessing merely consolidation, or is there potential for a downward spiral? An inability to hold above $2,500 could ignite further retesting of lower support levels, which is a scenario no trader wishes to envision. The market’s indecision reflected in recent volume declines adds another layer of concern. Until Ethereum can establish a strong rebound from the $2,400 threshold, there’s a risk of succumbing to momentum’s darker tendencies.

The Psychological Barrier of Volatility

Volatility is a double-edged sword in the cryptocurrency landscape, particularly with Ethereum. Traders ride waves of upward momentum filled with euphoria, yet the specter of a pullback lingers ominously, casting shadows over every hopeful projection. Even as Ethereum recently achieved its highest performance in months, one must remain keenly aware that such upheaval often precedes calm, requiring patience and astuteness.

The balance between maintaining bullish momentum and undergoing natural corrections is a defining feature of this volatile market. Rising above $2,700 is essential for bullish traders; yet, any indicative signs of weakness compel traders to reconsider their positions. For guidance, eyes should be trained on the lower-bound metrics: how Ethereum navigates the $2.400 and $2,200 support levels holds significant sway over its long-term viability.

In essence, Ethereum’s current standing symbolizes the broader cryptocurrency market’s ambitions and vulnerabilities. The tussle between hope and caution defines this period, compelling traders to balance their aspirations with analytical foresight. It is an intricate dance of numbers and sentiment, and one that requires an astute mind to navigate effectively. The cryptocurrency world is anything but predictable; as Ethereum strives for stability, the collective breath of the market hangs in the balance, waiting for its next move.

Leave a Reply