In the tumultuous realm of cryptocurrency, Ethereum has reached a critical juncture that echoes the broader anxiety permeating global markets. Recently, traders and enthusiasts alike have been grappling with a palpable tension—that the very foundation of Ethereum’s potential might be shaky at best. As Ethereum tread water at approximately $1,610, investors find themselves on the edge, confronting the stark reality imposed by macroeconomic turmoil, particularly the escalating trade tensions between the United States and China. This scenario is characteristic of a classic market conundrum often described as; “the calm before the storm.” Yet, as the narrative unfolds, one must wonder whether the storm is truly brewing or if it’s merely a mirage amidst volatility.

The recent announcement by former President Trump regarding a 90-day tariff reprieve for countries except China represents a puzzling dichotomy. On the one hand, easing tariffs could stabilize certain market factions; on the other, it intensifies the shadows of a drawn-out trade conflict. For crypto traders, who thrive on clarity, this fog of uncertainty proves particularly corrosive. Price sensitivity in the crypto market escalates under such circumstances, making every trade decision laden with risk. The question remains: can Ethereum defy the pessimistic current and emerge as a beacon in an uncertain economy?

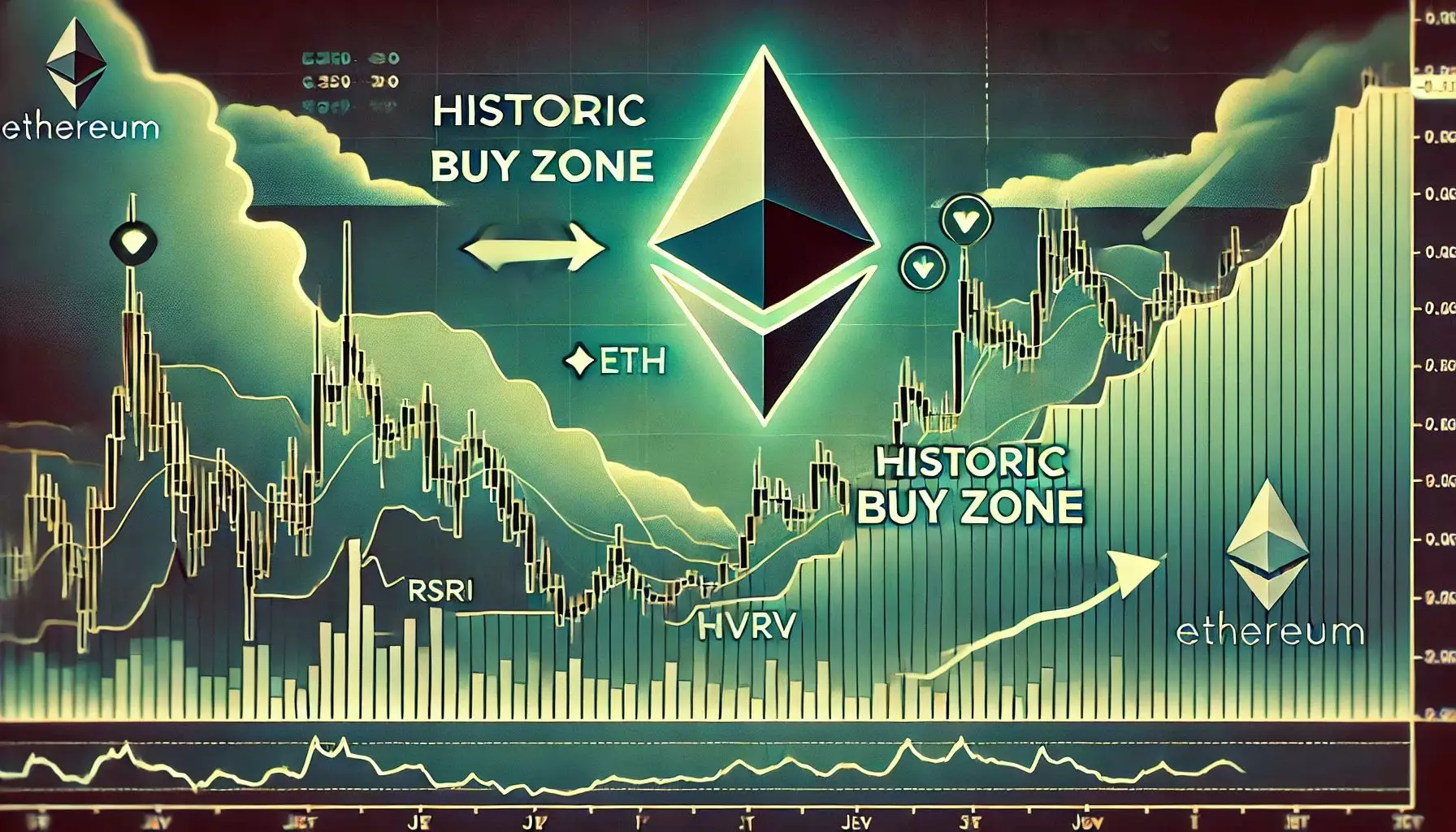

Historical Indicators: A Double-Edged Sword

Cryptocurrency experts such as Ali Martinez often refer to historic data as a key guide in navigating today’s rocky landscape. According to his analysis, significant buying opportunities for Ethereum have historically emerged when prices dipped below the lower MVRV (Market Value to Realized Value) Price Band. This might seem promising at first glance, yet it underscores a worrying trend: the need for aggressive buying to help turn the tide. With Ethereum currently situated within this seemingly favorable band, the question is whether it is truly a buying opportunity or a dangerous trap.

Previous examples illustrate similar situations where traders were lured into making purchases, only to be left holding depreciating assets in the wake of bad news. The reality is that while Ethereum’s price has hovered near this indicative band, negative macroeconomic trends present significant barriers to a potential rebound. Yes, there is a historical precedent suggesting that recovery could follow, but one must also acknowledge the risk that this particular situation is “different.” If Ethereum cannot propel itself out of the range it’s trapped in, the allure of accumulation could quickly dissolve into the lament of lost investments.

The Psychological Game Ahead

Trading crypto can often resemble a high-stakes psychological game, where sentiment dictates movements as much as technical indicators do. Ethereum now finds itself locked in a painfully narrow trading range between $1,550 and $1,630, a scenario that reflects not only market indecision but also investor anxiety. For bulls to regain momentum, a decisive move above the significant resistance level of $1,700 is imperative. Each moment that Ethereum flounders beneath that mark only reinforces bearish sentiments and puts more psychological pressure on holders.

An interesting dynamic arises: the critical levels around $2,000 not only serve as historical support but now loom as daunting resistance. Breaking through this barrier would unleash a wave of buying interest, possibly revitalizing the bullish momentum. Yet, the alternative—a breach of the $1,550 floor—could signal a stampede toward the $1,500 support level, where potential heartbreak awaits those who might have underestimated the intensity of the bear market.

Statements made by some analysts imply optimism, claiming it could be an opportune moment to buy, drawing parallels with historical trends. However, one must engage critically with this assertion. Do we throw caution to the wind amidst volatility and market fear, or do we proceed with the circumspection warranted by the current landscape? History may offer lessons, but history doesn’t dictate the future.

In navigating these murky waters, what weighs heavily on the minds of investors is not just the price but the very fabric of confidence that underpins the crypto movements—the conviction that tomorrow could be better than today. The unfortunate truth is that without a hint of positive external catalysts or some stabilization in global trade dynamics, Ethereum could find itself languishing in uncertainty for some time. The crypto world has witnessed many tragedies masquerading as bull runs—let’s not become overly enamored by temptation when the stakes are so remarkably high.

Leave a Reply