In a striking move, Gemini, one of the leading cryptocurrency exchanges in the United States, has announced it will no longer hire graduates or interns from the Massachusetts Institute of Technology (MIT). This decision stems from the university’s recent re-engagement with Gary Gensler, the former chair of the U.S. Securities and Exchange Commission (SEC). This article examines the implications of this stance within the context of the ongoing debate over regulatory frameworks in the cryptocurrency sector.

Public Messaging: A Clear Position from Gemini

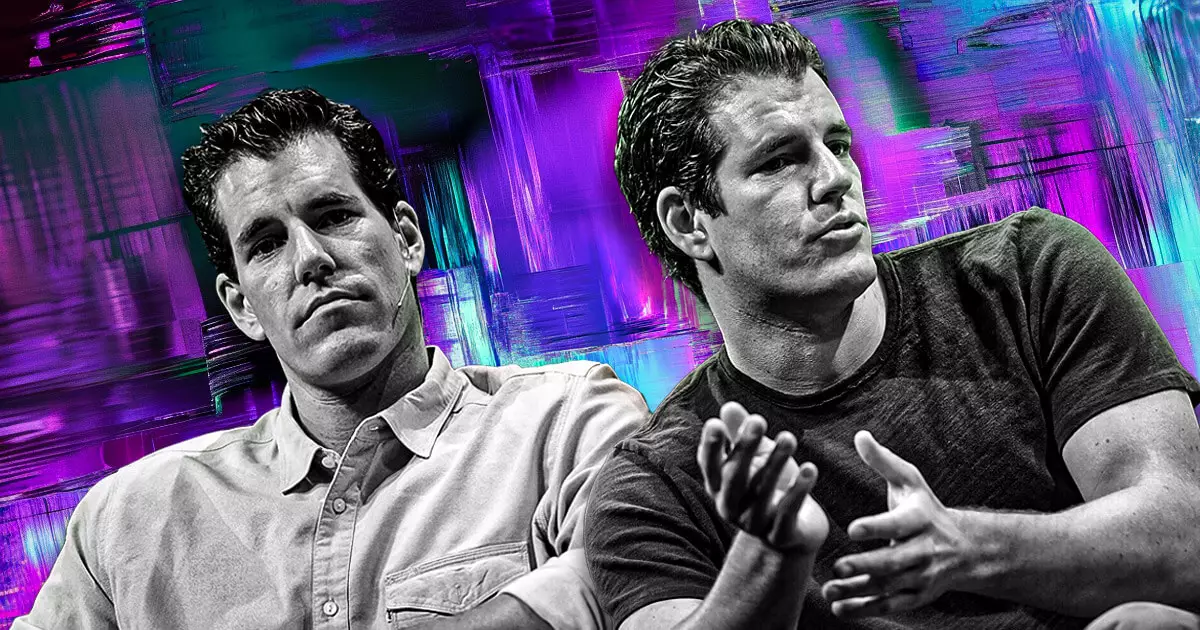

On January 29, Tyler Winklevoss, Gemini’s co-founder, took to social media to publicly declare that the exchange would not consider any candidates associated with MIT while it maintains ties with Gensler. This statement highlights not only Gemini’s disapproval of Gensler’s past actions as SEC chair—characterized by strict regulations—but also signals a greater discontent brewing within the crypto community regarding regulatory scrutiny. The determination to exclude MIT candidates signifies a broader critique of the institution’s decisions, raising vital questions about the alignment of educational institutions with regulatory figures seen as antagonistic to innovation.

Joining MIT as a Professor of Practice, Gensler will engage with subjects including artificial intelligence, finance, and public policy. His return has reignited discussions about his regulatory philosophy, particularly among those in the cryptocurrency and fintech spaces who view his tenure at the SEC as stifling to innovation. Critics label his hiring as a paradox, as they perceive an inconsistency between academic freedom and the suppression of groundbreaking technology that crypto represents. Gensler’s focus at MIT, particularly his co-leadership of the FinTechAI@CSAIL initiative, is viewed with skepticism by many in the crypto industry who fear that his influence may carry over into academic policies that could further dampen innovative efforts.

In response to Gemini’s bold move, influential voices in the crypto realm are rallying against MIT and its connection to Gensler. Matt Huang, co-founder of Paradigm, has urged professionals associated with MIT to voice their dissent, suggesting the potential for a more organized backlash against academia’s relationship with former regulators. Similarly, Caitlin Long, a significant figure in the crypto banking sector, questions whether this moment will trigger a seismic shift in the industry’s relationship with educational institutions that permit ex-regulators to play a prominent role.

Gemini’s decision to distance itself from MIT signifies more than just a corporate hiring strategy; it reflects the urgent need for a reevaluation of how regulators are perceived in relation to innovation-driven sectors. As the cryptocurrency industry continues to navigate a complex regulatory landscape, actions like those taken by Gemini may mark the beginning of a larger movement where innovative firms seek to redefine their partnerships with academic institutions and regulatory figures. As such, the tension between crypto innovation and regulatory bodies remains a critical battleground in shaping the future of the industry.

Leave a Reply