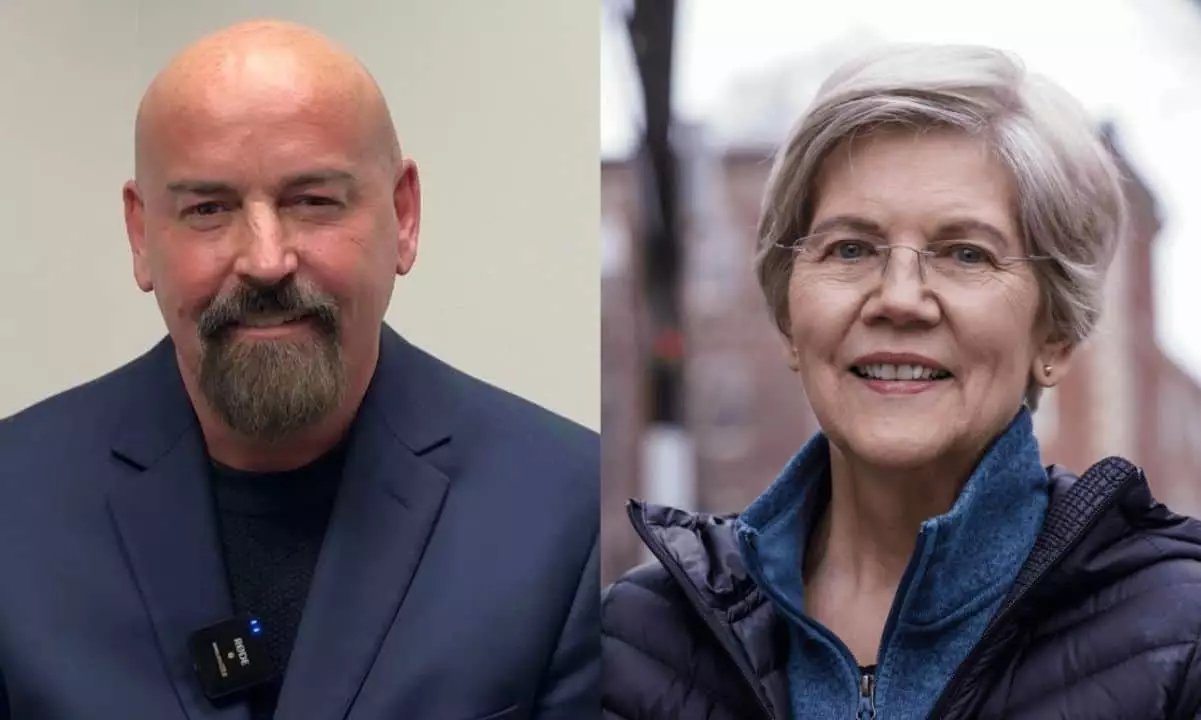

The recent debate between Elizabeth Warren, the long-serving senator from Massachusetts known for her skeptical stance on cryptocurrency, and John Deaton, an attorney and pro-crypto advocate, has stirred significant discourse in political and financial circles. The event spotlighted the stark contrast between their visions for digital assets and their implications for the broader American economy. This article delves deep into the key exchanges during the debate, dissecting the implications of their arguments and the pressing issues surrounding cryptocurrency regulation.

Senator Warren opened her arguments with a clear warning about the perils that cryptocurrency poses to the American financial landscape. Known for her consumer advocacy, Warren’s historical criticisms of the crypto sector are rooted in concerns regarding regulatory compliance and consumer protections. Throughout the debate, she stressed the idea that without strict regulatory frameworks, the burgeoning crypto market could be a breeding ground for financial crimes, including money laundering and fraud. Warren targeted Deaton’s potential positioning within the crypto community, accusing him of being overly influenced by industry stakeholders if elected.

Her assertion raises intriguing questions about the integrity of political candidates in an age where campaign financing often intertwines with sector interests. Critics of Warren may argue that instead of fostering an inclusive dialogue, her combative approach may alienate those advocating for financial innovation. The senator’s claim that “one candidate standing here is funded almost entirely by one industry” points to a systemic issue in financing political ambitions, where industries leverage financial contributions to influence policy direction.

In stark contrast, John Deaton defended the role of cryptocurrencies as potential tools for social equity, emphasizing their ability to democratize finance for those left underserved by traditional banking systems. He positioned his personal narrative — sharing how cryptocurrency benefited his family against predatory banking practices — as a testament to its transformative power. Deaton’s honest storytelling during the debate served not only as a personal anecdote but also illustrated a broader argument for the necessity of inclusivity in financial innovations.

Critically, Deaton framed Warren’s focus on regulating the digital asset space as misaligned with the current economic challenges facing the nation, specifically inflation and the high cost of living. By questioning why Warren attacks crypto more ardently than pressing economic issues, he highlights a potential disconnect between policymakers and the everyday struggles of their constituents. This appeal to prioritize constituents’ needs over regulatory zeal could resonate strongly in a climate where economic anxiety is palpable.

The debate also illuminated the complex relationship between political influence and regulatory measures. Deaton’s retort to Warren’s accusations of him being ‘beholden’ to crypto interests — pointing out her own history with corporate PACs — delves into a critical area of governance in contemporary America. It raises ethical questions: How should candidates navigate the fine line between representing industry interests and upholding constituents’ welfare? The intertwining of finance and politics remains a formidable barrier to reform, particularly in arenas like cryptocurrency, where innovation leaps ahead of policy frameworks.

Moreover, the concerns raised by both candidates cannot be dismissed lightly. Warren’s advocacy for a balanced approach acknowledges the potential advantages of cryptocurrency when subjected to rigorous oversight. Conversely, Deaton’s push for a less restrictive framework aims to preserve the benefits that crypto can bring without excessive governmental intervention. Their positions underscore the delicate balancing act required in the landscape of financial regulation — one that aims to protect consumers while fostering innovation.

The Warren-Deaton debate encapsulates the growing tension between progressive regulations and the push for innovation in cryptocurrency. As the industry evolves, these discussions will only gain importance, shaping both consumer protections and methods that industries adapt to regulatory environments. The outcome of this discourse may inform future legislation and define the trajectory of how digital assets are integrated within the American economic framework. Ultimately, the debate is less about the merits of cryptocurrency itself and more about the principles of governance, consumer protections, and the dynamic interplay between financial innovation and regulation.

Leave a Reply