Russia’s Ministry of Finance recently put forward a proposal to permit traditional exchanges to facilitate digital asset trading for specific investors. This move aims to create specialized regulations for organized trading in digital currencies, treating them as commodities and requiring an exchange or trading system license.

The proposal is limited to a select group of “particularly qualified” investors, with no specific qualification criteria outlined. This approach suggests a cautious and controlled expansion of digital asset trading within the existing financial framework.

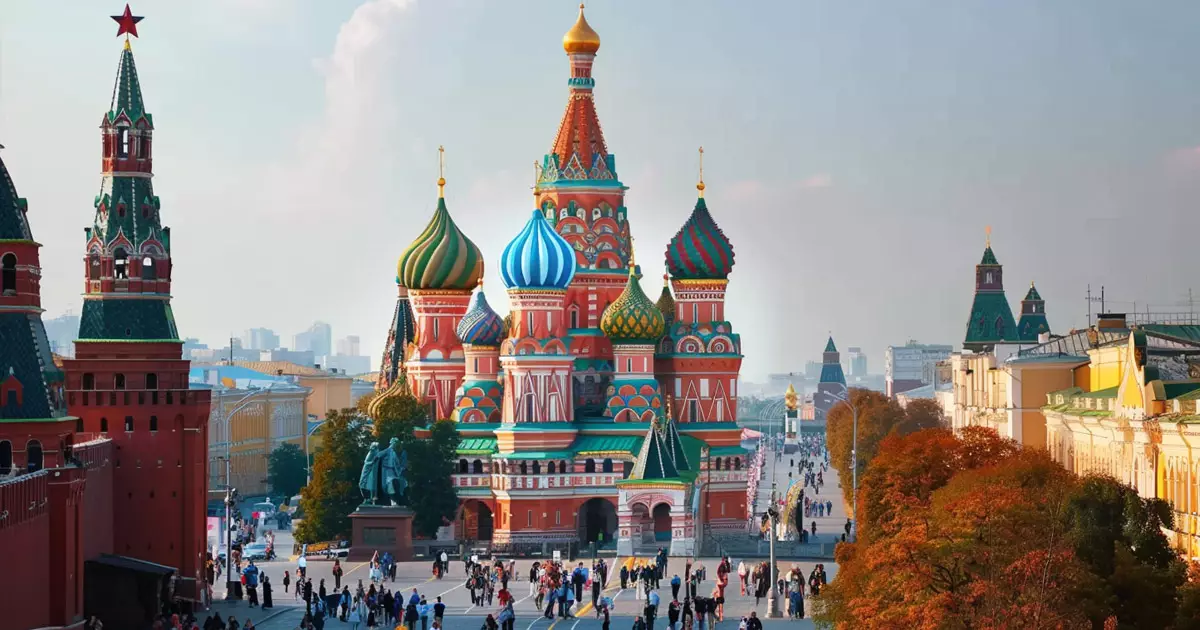

Russian Exchanges

As per the report, the Russian Central Bank’s register comprises seven licensed exchanges and trading systems, including well-known entities like Moscow Exchange and St. Petersburg Exchange. These established institutions are seen as well-equipped to handle crypto transactions, given the appropriate regulatory environment.

State Duma Committee

Anatoly Aksakov, Chairman of the State Duma Committee on Financial Markets, expressed confidence in the readiness of major Russian exchanges to support crypto activities, emphasizing the need for legal clarity to facilitate broader industry participation. He highlighted the ongoing efforts of certain exchanges in this regard.

Government Response

In addition to the exchange proposal, the government’s response touches upon crypto mining regulations and the experimental introduction of crypto settlements. The proposed measures seek to establish a formal status for digital currencies and enable foreign exchange transactions using digital assets.

Prime Minister Mikhail Mishustin has instructed relevant authorities to develop an international crypto payment mechanism by 2022. This initiative could empower the central bank to create an experimental crypto settlement platform, potentially revolutionizing cross-border transactions.

Regulatory Considerations

The draft response underscores the importance of general regulations that can accommodate digital asset payments in foreign trade, subject to the assets attaining recognized status. Moreover, Russia is exploring the legalization of stablecoins for international settlements and is actively pursuing the implementation of central bank digital currencies (CBDCs).

This comprehensive approach reflects Russia’s evolving stance towards digital assets, balancing innovation with regulatory oversight to foster a robust and inclusive financial ecosystem. As the country navigates the complexities of this rapidly evolving sector, collaboration between governmental entities, financial institutions, and market participants will be crucial in shaping a sustainable framework for digital asset trading.

Leave a Reply