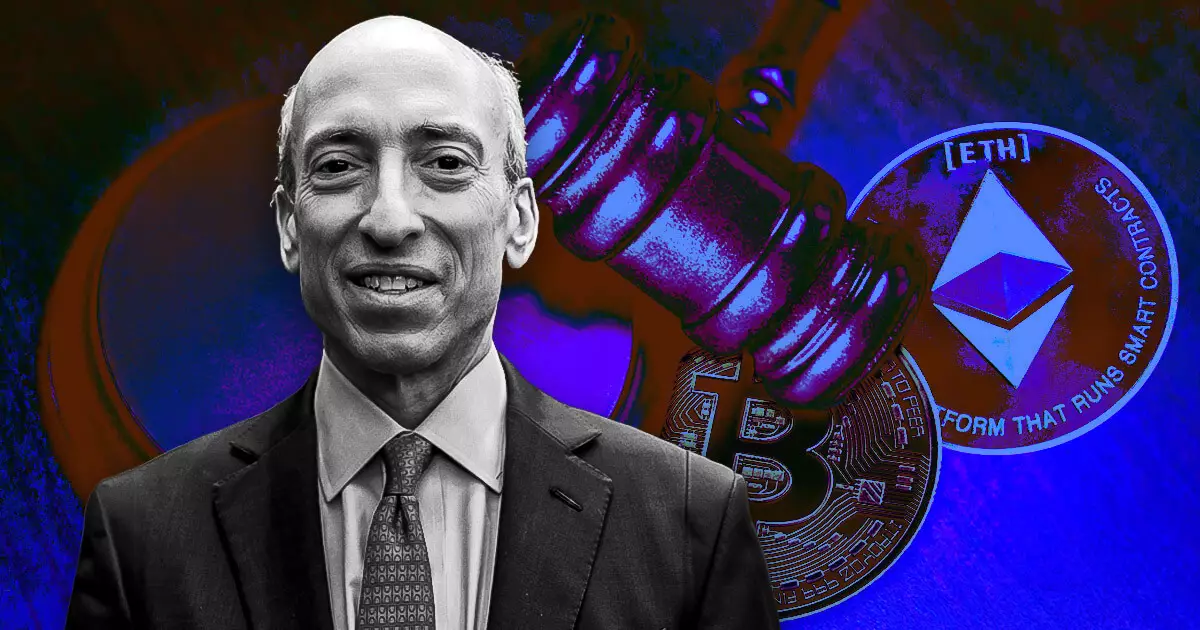

During a recent hearing, Judge Katherine Polk Failla expressed her disapproval of Coinbase’s attempts to subpoena SEC chair Gary Gensler in the ongoing case against the firm. Failla criticized the company’s request for Gensler’s statements before he became SEC chair in 2021, deeming Coinbase’s arguments as “speculative” and unpersuasive. She noted that obtaining Gensler’s pre-chair statements would be difficult and questioned the necessity of such inquiries, highlighting the potential burden of the process.

On the other side, SEC lawyer Jorge Tenreiro labeled Coinbase’s subpoena request as “incredibly intrusive” towards a public official. Tenreiro emphasized that the focus of the proceedings should be on the SEC’s actions rather than Gensler’s prior statements. He argued that Gensler is neither a fact witness nor an expert witness on the law, further urging the court to quash Coinbase’s subpoena request. Failla appeared to agree with Tenreiro’s sentiments about the disproportionate burden of probing into Gensler’s pre-chair communications.

Coinbase’s legal team referenced a previous case involving Ripple where the court ordered the discovery of multiple custodians, including then-SEC chair Jay Clayton. This comparison was meant to justify the breadth of Coinbase’s request for information regarding Gensler’s public comments on various topics related to digital assets. However, Tenreiro responded with a filing seeking to restrict Ripple from accessing certain information, including by searching SEC staff’s personal devices, indicating the complexities surrounding regulatory subpoenas in cases of this nature.

Coinbase’s Defense

In its defense, Coinbase argued that Gensler’s personal communications are relevant to its case, particularly in relation to a fair notice defense. The company claimed that Gensler’s past statements could influence its expectations regarding potential SEC actions against it. The lawsuit initiated by the SEC in June 2023 accused Coinbase of operating as an unregistered exchange, broker, and clearing agency, as well as engaging in unregistered offerings and sales of securities through staking-as-a-service.

Despite the Judge’s criticisms and the SEC’s objections, Coinbase has persisted in its efforts to obtain information pertaining to Gensler’s communications. The ongoing legal battle highlights the complexities and legal nuances involved in cases where high-profile individuals, such as government officials, are subpoenaed for information. The outcome of this case could set a precedent for future regulatory disputes and could shape the boundaries of discovery in similar cases moving forward.

While Coinbase’s attempts to subpoena SEC chair Gary Gensler may be met with criticism and resistance, the company’s persistence reflects its commitment to defending itself against the allegations brought forth by the SEC. The legal intricacies surrounding this case underscore the challenges of navigating regulatory investigations and highlight the need for clarity and transparency in regulatory processes involving digital assets and securities. The ultimate resolution of this case will undoubtedly have far-reaching implications for the cryptocurrency industry and the regulatory landscape as a whole.

Leave a Reply