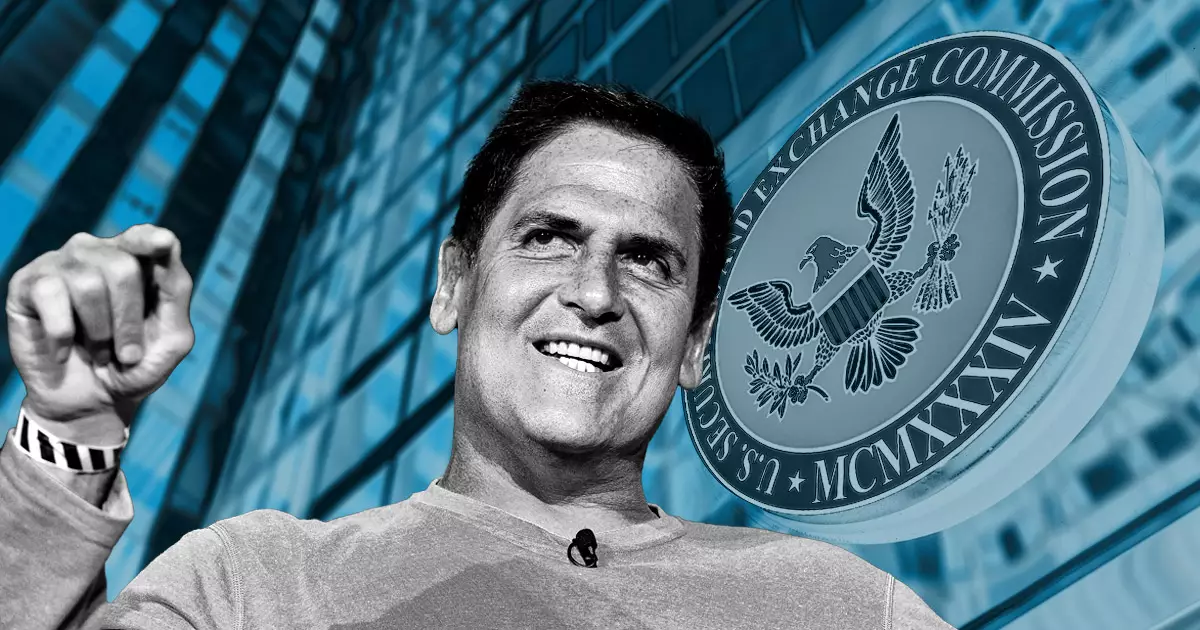

Billionaire investor Mark Cuban recently highlighted the challenges faced by token-based companies when it comes to registering with the US Securities and Exchange Commission (SEC). Cuban’s concerns stem from SEC Commissioner Mark Uyeda’s acknowledgement that the current approach to crypto disclosure filings is “problematic.” The existing Form S-1, which is required for companies to offer new securities publicly, may not be suitable for most crypto issuers due to their unique characteristics.

Form S-1 plays a crucial role in providing essential information about a company’s business operations, risk factors, and product offerings. Companies looking to trade their security shares on major exchanges like the New York Stock Exchange must file this form. However, Uyeda pointed out that the current requirements under Form S-1 may not align with the specific needs of crypto companies, potentially leading to irrelevant or missing information in the registration statement.

Recognizing the challenges faced by crypto issuers, Uyeda suggested allowing variances in Form S-1 filings similar to those granted for funds and insurance products. By tailoring the disclosure requirements to better suit the nature of crypto digital assets, Uyeda believes that companies can provide more relevant information to investors, thereby enhancing investor protection under the Securities Act.

Mark Cuban voiced his support for Uyeda’s proposal, emphasizing that the issue lies not in the reluctance of crypto companies to register but in the mismatch between the requirements of Form S-1 and the unique characteristics of token-based businesses. Cuban’s statement reflects the industry-wide sentiment that existing regulations may not adequately address the complexities of the crypto space.

Similarly, the US Blockchain Association commended Uyeda for his thoughtful engagement with the industry, highlighting the importance of regulatory flexibility in accommodating the evolving needs of crypto companies. The recognition of these challenges underscores the significance of revisiting existing regulatory frameworks to foster innovation and growth in the digital asset ecosystem.

The call for modifications to Form S-1 filings for crypto companies reflects a growing recognition within the industry and regulatory bodies of the need to adapt to the changing landscape of digital assets. By addressing the unique characteristics and requirements of token-based businesses, regulators can create a more conducive environment for capital formation and investor protection in the crypto space.

Leave a Reply