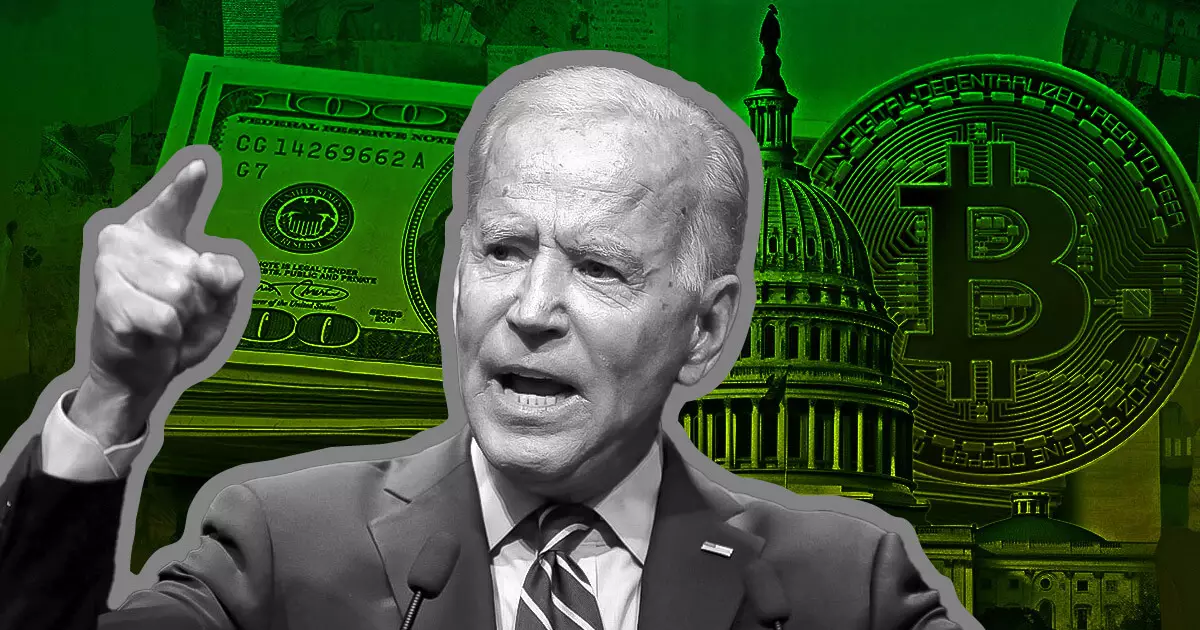

Upon vetoing H.J. Res. 109, US President Joe Biden cited the SEC’s controversial SAB 121 rule as embodying the “considered technical” views of SEC staff. He argued that overturning the rule would impede the SEC’s ability to establish guidelines and address potential risks, thereby diminishing the agency’s control over accounting practices. Furthermore, Biden highlighted the rule’s significance in safeguarding the public’s interests, asserting that his administration prioritizes consumer and investor well-being over regulatory rollback.

Despite Biden’s position, the political landscape surrounding H.J. Res. 109 remains contentious. While the President characterized the resolution as a “Republican-led” initiative, proponents of the bill stress its bipartisan nature and urge against a veto. However, voting records reveal a predominantly Republican support base for the resolution, raising questions about the true extent of bipartisan cooperation in the legislative process. The divide between parties underscores the complex nature of crypto regulation and the challenges in finding common ground.

In the debate surrounding SAB 121, contrasting viewpoints emerge among lawmakers and industry stakeholders. Congressman Patrick McHenry voices concerns about the rule’s restrictive implications, arguing that the SEC overstepped procedural boundaries in its formulation. On the other hand, Democratic senator Elizabeth Warren contends that the rule is less burdensome than critics suggest, emphasizing the importance of regulatory oversight in protecting consumers. Meanwhile, the American Bankers Association (ABA) acknowledges the rule’s restrictive nature but advocates for modifications rather than complete repeal, showcasing a nuanced approach to regulatory compliance.

By vetoing H.J. Res. 109, President Biden addresses a specific legislative effort aimed at overturning SAB 121. However, the veto fails to resolve underlying issues and concerns raised by both proponents and opponents of the rule. The lack of direct engagement with substantive critiques leaves the door open for potential future challenges and revisions to the regulatory framework. As stakeholders grapple with the complexities of crypto regulation, the path forward remains uncertain, requiring a delicate balance between innovation and investor protection.

Leave a Reply