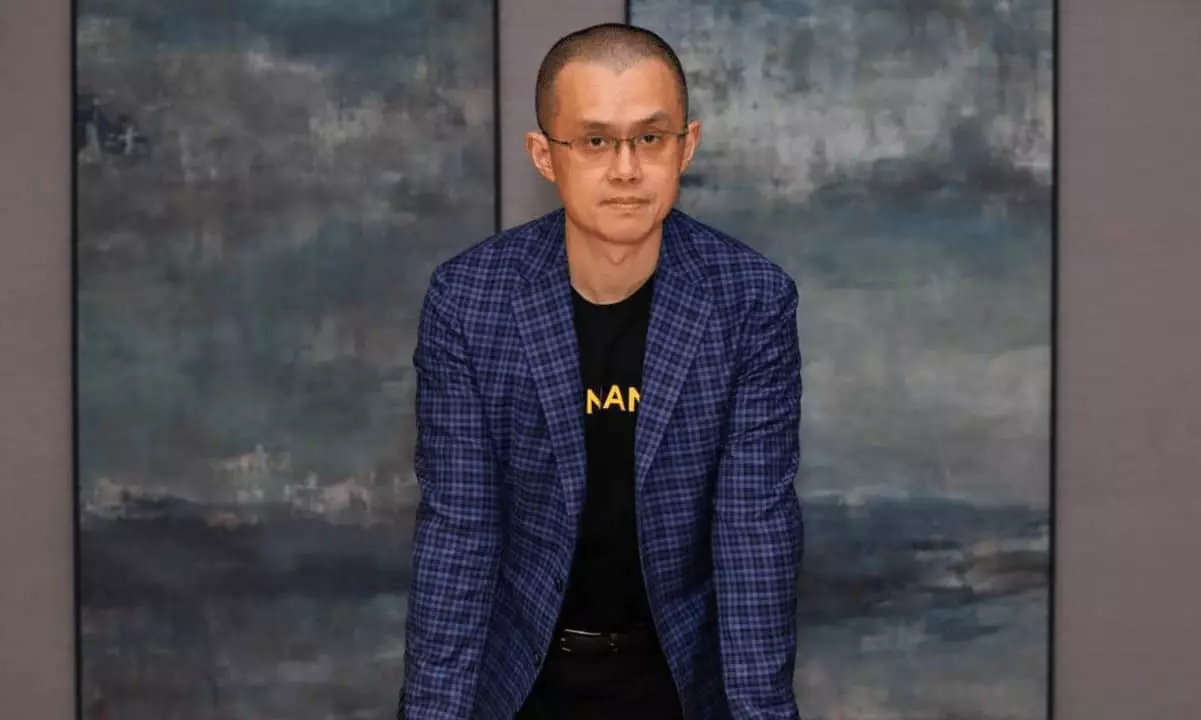

As the cryptocurrency landscape continues to expand at an unprecedented rate, the pressing issue of digital asset inheritance has taken center stage. Recognizing this critical need, Changpeng Zhao, the founder of Binance, has proposed the introduction of a “will function” across crypto platforms. This forward-thinking feature inherently acknowledges the reality that many crypto holders tragically pass away unexpectedly, leaving their families in the dark about their digital fortunes. Each year, a staggering amount—estimated at over $1 billion—of cryptocurrency is lost to centralized exchanges due to accidental deaths. In light of such staggering figures, it is abhorrent that the industry has not yet prioritized seamless inheritance solutions, effectively forcing grieving families into a labyrinth of bureaucracy and uncertainty.

The Emotional Toll of Digital Asset Loss

Admittedly, discussing inheritance is often uncomfortable, yet it doesn’t negate its importance. More tragically, many traders neglect to inform their loved ones about their holdings or platforms, leading to a painful reality: dying with assets that effectively vanish into thin air due to mishandling by exchanges. The emotional toll this mismanagement imposes on families grappling with loss cannot be overstated. While Zhao’s push for crypto inheritance planning resonates on a logical front, it is overwhelmingly rooted in the human experience.

Binance’s Response and Competitive Landscape

In a proactive move, Binance rolled out its “emergency contacts and inheritance heir” feature, allowing users to designate beneficiaries for their cryptocurrency assets. This is commendable; however, the approach is not without its flaws. Competitors like Coinbase and BitGo have taken more traditional paths, focusing on legal documentation and third-party partnerships for estate planning. While these may be suitable for some, systems that require cumbersome legal processes may be intimidating and off-putting for average users. It includes a layer of complexity that can alienate potential investors, ultimately stunting growth in the market.

One must question if Binance’s approach goes far enough. Considering the digital asset space’s immense complexity and evolving regulations, relying solely on listed emergency contacts does not constitute comprehensive inheritance planning. Are we really prepared to leave this vital task in the hands of users who may not fully understand the implications of their selections?

Regulatory Oversight and Accountability

Zhao’s appeal extends beyond platform capabilities; it also touches upon regulatory conditions that would allow minors to inherit digital assets legally. This is crucial in cultivating financial literacy among younger generations. Yet, regulatory bodies have lagged in adapting to the unique challenges presented by cryptocurrencies. The outdated frameworks currently used for traditional assets cannot possibly accommodate the dynamic and digital nature of crypto. In a progressive society, adapting regulations to match technological advancements is not merely preferred; it’s essential.

The industry stands at a crossroads where proactive measures are not just encouraged but mandatory. Financial institutions, regulators, and crypto platforms alike share a collective responsibility to safeguard users’ legacies. Failure to act swiftly and decisively could result in a culture of lost wealth, with current and future generations bearing the brunt of this negligence.

In a sector driven by innovation and revolution, it’s time we prioritize the human side of cryptocurrency, especially when it comes to such a critical issue as asset inheritance. The lessons learned from the past year’s drawbacks must give way to more robust protections and features, ensuring that every crypto enthusiast can rest easy knowing their legacy will thrive, even when they cannot.

Leave a Reply