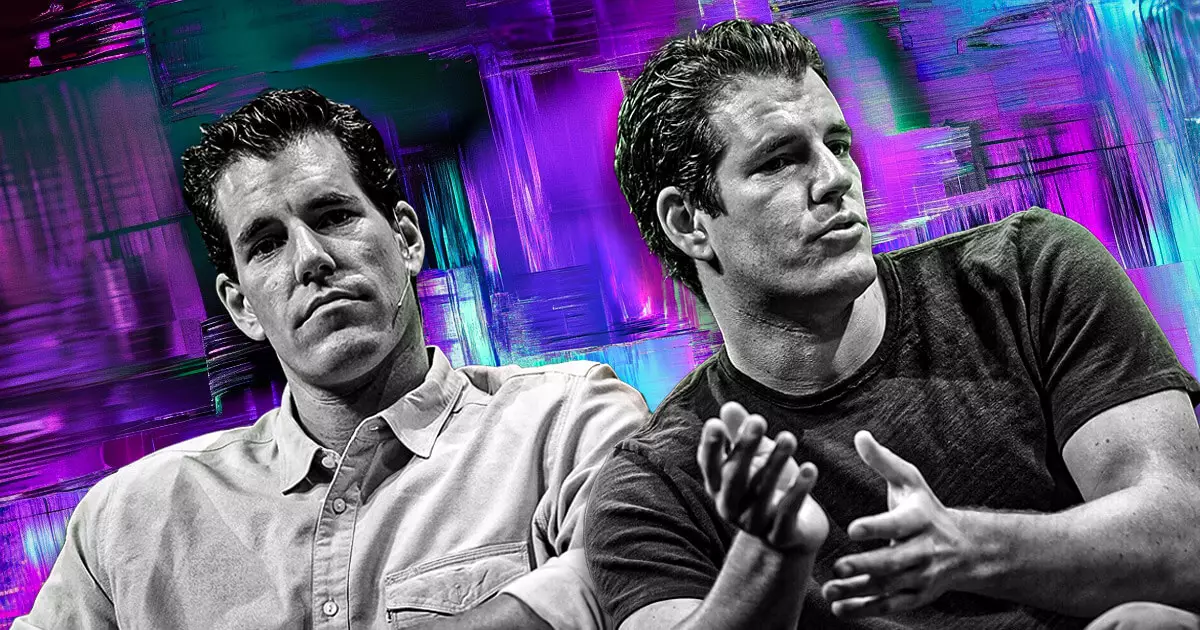

Gemini’s recent decision to file a draft registration statement with the US Securities and Exchange Commission (SEC) for an initial public offering (IPO) is a bold move that illustrates both ambition and acumen. The twin exchanges, led by the Winklevoss brothers, are not merely capitalizing on a fleeting trend; instead, they are strategically timing their entry into the public markets amid a burgeoning acceptance of cryptocurrency assets. As June unfolds, the favorable market conditions, coupled with a White House that appears more receptive to digital currencies, create a ripe environment for the IPO. This political climate could potentially encourage many other cryptocurrency exchanges to follow in Gemini’s footsteps.

The SEC: A Necessary Hurdle

Facing the SEC might deter some companies, but for Gemini, it represents an opportunity. The regulatory body’s approval is essential before any sales can commence, and Gemini stands at a pivotal junction. They will need to address the SEC’s remarks and update financial statements effectively, showing their transparency and adherence to legal frameworks. While these requirements may seem burdensome, navigating them successfully can establish trust with potential investors, who are often wary of the crypto market’s volatility. If they manage to leverage their compliance into a compelling narrative, they might not only attract public interest but also instill confidence in an often skeptical investor base.

Ripple Effects from Circle’s Strong Performance

Gemini’s entry into the public sphere is also contextualized by the impressive debut of Circle on the New York Stock Exchange. Circle’s share price soared initially, only to level off somewhat, which reflects typical market behaviors but also showcases the appetite for crypto-related equities. Circle’s dramatic first-day returns are being hailed as a beacon of success — a potential template for Gemini and others contemplating the public route. This enthusiasm signals that investors are eagerly looking for revenue-generating platforms within the digital asset space, a sentiment that Gemini aims to capture with its own operational model.

Competition and the Second Wave of Crypto IPOs

Gemini’s IPO ambition is part of a broader narrative involving several crypto firms also eyeing public listings. Kraken’s potential IPO, led by prominent investment banks like Goldman Sachs and JPMorgan, further muddies the waters but also invigorates competition. The cryptocurrency realm is no longer a fringe ecosystem; it is on the brink of mainstream acceptance, and Gemini’s foray will likely galvanize other players to push their own IPO timelines. As competition heats up, firms will need to innovate and differentiate themselves, leading to enhanced services and products for consumers.

Bridging the Gap Between Traditional and Crypto Markets

Lastly, Gemini’s IPO could play a crucial role in bridging the divide between traditional finance and the burgeoning crypto markets. By taking this step toward public trading, they stand to symbolize the integration of digital assets into mainstream finance, potentially influencing regulatory frameworks and public perception. This could have a transformative impact on the way investors, both institutional and retail, view cryptocurrencies, moving them from speculative assets to serious investment vehicles. Gemini’s IPO isn’t just a financial maneuver; it is a defining moment for the crypto industry that could set the tone for what comes next in this rapidly changing landscape.

Leave a Reply