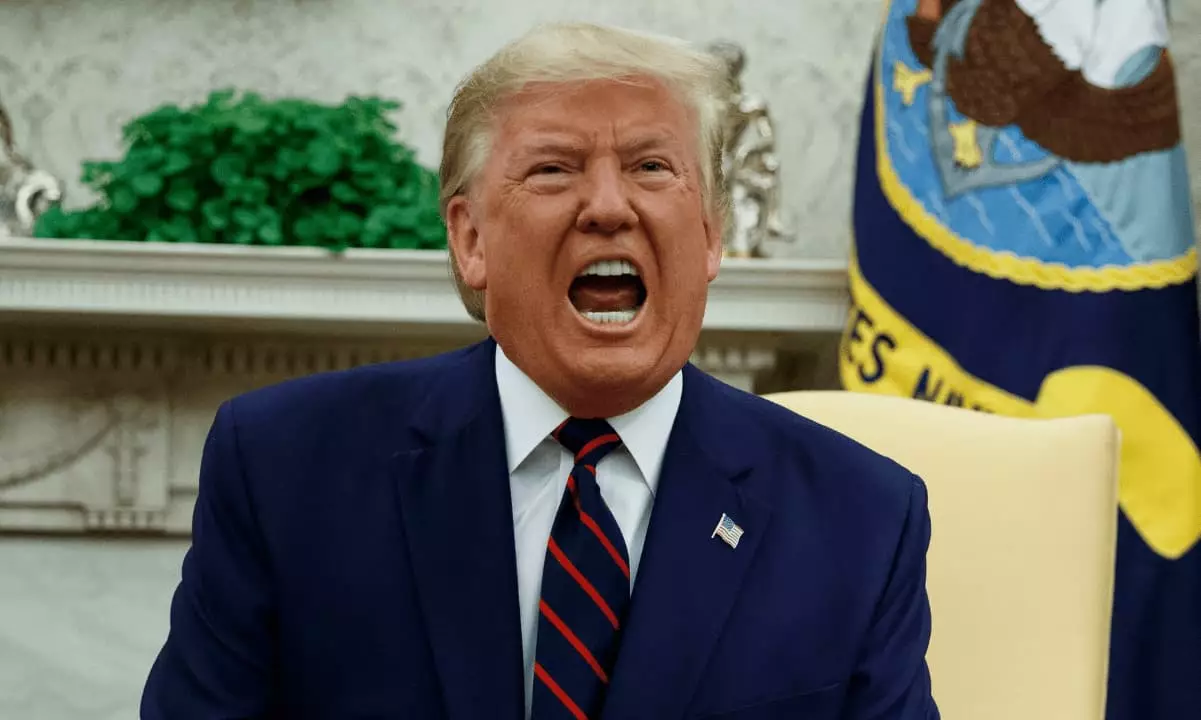

In an era defined by the rapid advancement of technology, the intersection between politics and digital currency has raised eyebrows across the political spectrum. The recent inquiry launched by top House Democrats into President Donald Trump’s cryptocurrency endeavors is not merely a political vendetta but rather a critical investigation into potential malfeasance that underpins our democratic apparatus. Delving into the heart of this inquiry opens a Pandora’s box of concerns over fundraising practices, foreign influence, and the potential conflation of business interests with presidential authority.

This scrutiny begins with a well-documented list of Trump’s crypto affiliates, which indicates the layered complexities of fundraising platforms tied to political campaigns. The House Democrats, led by Gerald Connolly, Joseph Morelle, and Jamie Raskin, have raised alarm bells regarding the WinRed platform, alongside political action committees like Elon Musk’s America PAC and Trump’s own World Liberty Financial (WLF). It is astonishing to consider that a political fundraising mechanism traditionally associated with conservative campaigns may serve as a conduit for illegal practices marred with allegations of corruption.

Funds and Foul Play: The WLF Token Sale

At the center of this investigation is the WLF token sale, heralded as a fundraising initiative yet steeped in controversy. When this venture predictably failed to meet its initial targets, a $75 million lifeline from Justin Sun, the Tron crypto founder under SEC scrutiny, raises an eyebrow for more than just financial reasons. With dealings that skirt near the edge of legality, the nature of such a transaction can’t help but evoke concern over favoritism and potential backdoor dealings between the political elite and cryptocurrency moguls.

The Democrats’ allegations of insider trading and “pump-and-dump” schemes linked to meme coins like TRUMP and MELANIA are not just exaggerated claims; they expose the very real risks of unregulated political involvement in cryptocurrency. The distribution of these tokens, ostensibly controlled by Trump’s affiliates, adds an unsettling layer to the narrative. If these tokens are held predominantly by entities tied to political power, one can’t help but question the ethical implications of such a setup.

The Foreign Influence Conundrum

Adding fuel to the fire, the anonymous nature of cryptocurrency transactions muddies the waters of national security. The report highlights the fact that a significant chunk of the WLF tokens were sold to foreign investors, including individuals linked to China. This loophole in transparency poses a very real danger: an avenue for foreign entities to gain undue influence over American public policy. The consequences of this could be massive, ultimately undermining the core tenets of American governance.

The involvement of foreign interests raises questions about Trump’s ethical and moral compass in the cryptocurrency realm. Are these financial maneuvers simply benign business transactions, or are they manifestations of an opportunistic approach that values profit over patriotism? This question begs a deeper exploration into how intertwined business interests and political authority can lead to a hazardous quagmire.

Conflicts of Interest: A Looming Threat

Trump’s announcement of the USD1 stablecoin as a precursor to a $2 billion investment by a fund backed by Abu Dhabi paints a grim picture of conflicts of interest. This relationship is indicative of how business ambitions can influence political decisions, particularly when they involve entities with checkered pasts like Binance, which has faced legal challenges under U.S. anti-money laundering laws. It raises an urgent question: how can a sitting president ethically navigate such treacherous waters without endangering national stability?

As legislative pressure intensifies, with Democrats like Ritchie Torres advocating for restrictions on profit-making from meme coins and stablecoins, one cannot overlook the crucial role that regulatory frameworks must play to curb potential abuses. The recent failure of the GENIUS Act, aimed at imposing stricter guidelines on stablecoins, highlights the challenges in striking a balance between innovation and ethical governance.

The fusion of politics and cryptocurrency poses a risk that cannot be overstated. The inquiry into Trump’s dealings is not just a routine bureaucratic maneuver; it signifies an existential crisis for our political landscape. As we continue to grapple with the implications of digital currency, the need for vigilant oversight becomes ever more paramount to safeguard the integrity of our democracy.

Leave a Reply